Ranked Number 1 in

Digital Lending

Intellect Digital Lending (IDL)

Intellect Digital Lending (IDL) is a cutting-edge digital credit management system designed to meet the ever-changing needs of credit seekers and financial institutions alike. The comprehensive digital lending software empowers financial institutions (FIs) to seamlessly offer both commoditized and specialized credit products across diverse business segments, including Retail, Corporate, SME, and Agri. With Intellect Digital Lending, FIs can navigate the digital landscape with confidence, ensuring a streamlined and efficient approach to meeting the evolving demands of the credit market.

Embracing the 'Always On, Always Aware' concept, IDL enables banks to provide a truly digital, real-time solution to their customers. Real-time, informed credit decisions empower banks to grant customers a 360-degree view of their credit portfolio. Following a DIY principle, the system allows banks to create their products on-the-fly, ensuring flexibility anytime, anywhere. The fully automated, robust architecture of IDL guarantees a lower cost of operation by driving enhanced efficiency.

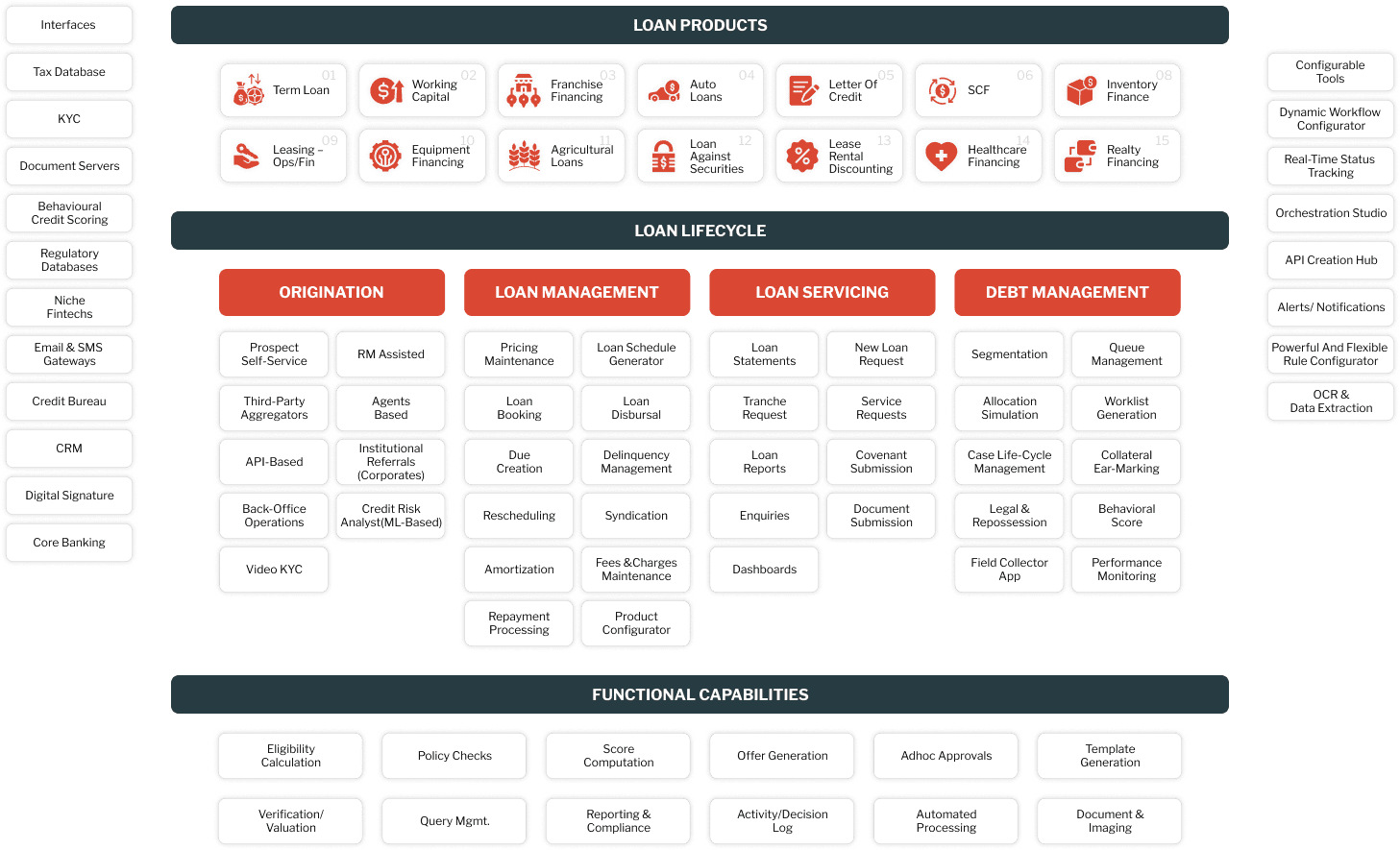

IDL serves as an all-in-one lending platform, seamlessly integrating Credit Origination, Loan Servicing, Debt Management, and Collateral & Limits Management systems. Each of these components is also available as standalone products, catering to businesses at various stages of digital credit transformation.

Elevate your lending experience with IDL, the award winning Retail Lending Software that prioritizes efficiency and adaptability for a comprehensive, streamlined lending process.

IDL is an all-in-one lending platform for comprehensive digital credit transformation

Seamless Onboarding Experience

Reduce Time To Market

Minimize Credit Risks

Maximize Collections

- Omni-channel Origination with Customer Initiated/ RM Assisted Journeys

- API-Based Origination Enabling Collaboration With Fintechs

- Digital Data Aggregation Through Structured and Unstructured Data Sources

- Zero Touch Documentation Enabled by Digital Signatures

- Powerful Product Configuration Engine

- Superior Flexibility in Amortization

- Loan Restructuring & Modifications

- Exhaustive Loan Parameters

- Centralized Real-Time Monitoring Across Varied Lines Of Business

- Multi-Dimensional Exposure View

- Single View Of Borrower’s Exposure Across Multiple Levels

- Real-Time Margin Tracking

- Real-Time Loan Performance Analysis

- Intuitive Collection Score For Segmentation

- Personalized Follow Up

- Customer-Centric Strategies and Streamlined Collection Processes

Digital Lending - Overall Architecture

End-to-end Credit Lifecycle Management

With Intellect Digital Lending, Banks and Financial Institutions Can Ensure

Loved by leaders

The new platform will provide us with strength and the opportunity to accelerate our processes for innovation, product development and go-to-market.

Nils Carlsson

CEO, Resurs Bank

The unique Commercial Loan Origination platform enables YES BANK to extend commercial lending products and services with versatile integration capabilities through open APIs.

Anup Purohit

Chief Information Officer, YES BANK

Recognized by experts

Ranked number 1 for Retail Lending in IBS Annual Sales League Table 2022

Ranked number 1 for Product Breadth in IBS Annual Sales League Table 2022

Regional Leader (ASEAN) in IBS Annual Sales League Table 2022

Ranked number 1 for Retail Banking for the sixth consecutive year in Annual Sales League Table 2022

IDL Offerings

Reduce Customer Onboarding Times from Days to Seconds!

Drive Smarter and Faster Origination with Intellect Loan Origination System

Minimize Your Bad Debts

Manage Delinquent Customers Proactively and Effectively with Intellect Debt Management System

Limit Your Credit Exposure, Not Your Business

Comprehensive & Multi-dimensional Exposure Management with Intellect Collateral and Limit Management System

News

All NewsKnow More