Embrace the power of AI for faster and more informed credit decisions

Traditional credit origination has long been a bottleneck - with cumbersome processes, extensive paperwork, and delayed decision-making- inhibiting the growth and efficiency of banks and their SME customers. Enter the era of Kiri, a game-changer poised to transform the landscape. By leveraging the power of Generative AI, Kiri enables you to break free from the shackles of slow credit decisions.

Turn Chaos Into Clarity - Leverage advance machine learning programs to seamlessly extract and organize vital customer data from a myriad of documents

Turn Data into Dynamism - Ensure data accuracy by validating loan document information in real-time through industry interfaces.

Turn Insights into Impact - Equip your underwriters with instant access to summarized data, real-time insights and thorough risk assessment, harnessing the power of LLM and Gen AI.

With Kiri, liberate yourselves and your SME customers from the constraints of traditional credit origination, ushering in a new era of agility and growth.

Why Kiri

Empower customers by enabling self initiation across channels

Get a consolidated view of all your Critical Data

Translate data into Actionable Insights

Provide Strategic Knowledge to Underwriters

● Enable your SME prospects to self initiate their loan application across multiple channels with minimal information and document requirements.

● Streamline the onboarding process with a one-click email template and attaching the required documents in the e-mail for swift initiation.

● Drive AI-based data extraction and classification from loan documents to seamlessly present a singular view, facilitating rapid processing

● Empower your relationship managers to seamlessly reengage with prospects for missing, incorrect, or expired document details through dynamic email templates

● Ensure accuracy and authenticity by validating and verifying the extracted data from loan documents through strategic interfaces with industry agencies.

● Utilize real-time checks on policies, deviations, collaterals, and limits to check the adherence to risk assessment guidelines

● Accelerate analysis through summarization, insights, and risk assessments by harnessing the power of LLM and Gen AI

● Empower underwriters with comprehensive real-time information through interactive prompts to an AI-enabled chatbot

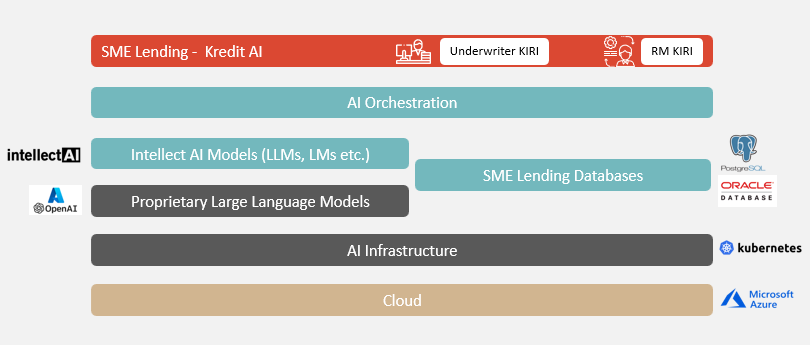

Solution Architecture

Our Partners

Gen AI - Creating Waves in the Credit Industry

What They Have To Say

"The remarkable achievement of finishing our project in just four months was made possible by the collective effort and expertise of our skilled team members, spearheaded by Intellect."

Muaz Termaz

SVP Head, Delinquent Collection, The Saudi National Bank (SNB)

“It has been quite a year for Intellect Design Arena. For the sixth year in a row, the company retained the top spot in the Retail Core Banking category, performing strongly in the APAC region, followed by Africa and Europe. Intellect Design Arena also racked up its third year as leader of the Wholesale Transaction Banking category. The company was a clear leader here with a nearly equal number of deals from the Americas, Europe, and the Middle East. It was also the second year running that Intellect Design Arena held the top position in InsurTech. In fact, it is worth noting that Intellect Design Arena has held top slot in the latter two categories since both the InsurTech and Transaction Banking categories were first introduced to the IBSi SLT!”

Robin Amlôt

Managing Editor, IBS Intelligence

“Our Vision at My.t Money is not only to make payment fast, secure and simple but also fun. We are also looking to drive strong continuous engagement by delivering value to consumers through access to things they want—coupons, loyalty rewards, gift cards, tickets, loans and more. iGCB’s experience in enabling leading organizations across the world to provide a superlative and seamless customer experience convinced us that they are the right partner for the next stage of our digital transformation and financial inclusion journey. We are confident that iGCB will enable Mauritius Telecom to not just deliver innovative financial solutions but also provide our customers an enhanced experience.”

Sherry Singh

CEO, Mauritius Telecom

“Our goal for this transformation was to empower our employees with the right tools which can help them deliver world-class banking to Myanmar citizens. We found Intellect Digital Core, most aligned to the needs of a growing bank with its robust technology stack and on-time deployment record. We are very excited to begin our journey.”

Mr.Htun Htun Oo

Dy CEO/BOD consultant, Mineral Development Bank

“We’re delighted to partner with Intellect GCB and establish the Cloud Centre of Excellence. As Intellect GCB’s customers look to rapidly enhance their digital capabilities in a multi-cloud world, the Centre of Excellence will help them mitigate risk, ensure compliance, and reduce time to market. We’re already seeing customer validation of our partnership, and iGCB’s choice of VMware Tanzu reaffirms our position as the industry-leading modern application platform”.

Pradeep Nair

Vice President and Managing Director, VMware India

The unique Commercial Loan Origination platform enables YES BANK to extend commercial lending products and services with versatile integration capabilities through open APIs.

Anup Purohit

Chief Information Officer, YES BANK

Intellect’s Contextual Digital Banking suite, IDC, has not only enabled us to acquire new customers but also facilitate our drive towards market leadership with an open & connected partner ecosystem.

Jon Howe

Managing Director , Cater Allen

We found the Intellect Digital Core banking suit a good fit with our business and operational goals.

MFTB Bank

Intellect felt like a natural partner in our digital journey because of their deep domain expertise, formidable range of digital capabilities and customer-first mindset.

Don Coulter

President and CEO, Wyth Financial

Recognized by experts

Intellect Ranked No. 3 in Global Leadership – Geographic spread in IBSi Sales League Table 2024

Intellect Ranked No. 2 among Regional Leaders in North America in IBSi Sales League Table 2024

Ranked No. 2 Islamic – Retail Lending in IBSi Sales League Table 2024

Ranked No. 2 Islamic – Digital Banking & Channels in IBSi Sales League Table 2024

Ranked No. 4 Wholesale Banking - Treasury & Capital Markets in IBSi Sales League Table 2024

Ranked No. 2 Digital Banking & Channels in IBSi Sales League Table 2024

Ranked No. 1 Retail Lending in IBSi Sales League Table 2024

Ranked No. 1 Retail Core Banking in IBSi Sales League Table 2024

Globee Golden Bridge 2024 award - Live Event of the Year (Bronze) for Money 20/20 Europe 2023

Globee Golden Bridge 2024 award - Company of the Year (Information Technology Software) (Silver) for iK Read More

Globee Golden Bridge 2024 award - Information Technology (Software) Innovation (Gold) for iKredit360 Car Read More

IDC won DigiBank Ethiopia 2023 Awards for 'Excellence in Customer Experience' for Ahadu Bank implementation Read More

iGCB's Digital Engagement Platform (earlier called CBX-R) won Best Omnichannel Technology Implementation for Read More

Intellect has been recognized among global suppliers of Treasury and Capital Markets systems in the IBSi 2021 Read More

Capital Cube is rated as Category Leader in the FinTech Quadrant for portfolio management platforms, 2021

Capital Cube is rated as Best of Breed in the RiskTech Quadrant for LRM solutions, 2021

Capital Cube is rated as Best of Breed in the RiskTech Quadrant for FTP solutions, 2021

Capital Cube is rated as Best of Breed in the RiskTech Quadrant for ALM solutions 2021

Capital Cube is recognized amongst "Category Leaders" in the Chartis' report titled Portfolio Management Pl Read More

Intellect is ranked among top 40 vendors in RiskTech 100 2023 rankings

Intellect has been ranked #1 in the 2022 edition of Global Leader in Product Breadth

Rated as a Leader in 'The Forrester Wave Digital Banking Processing Platforms for Retail Banking, Q3 2022'

Winner for Most Effective Digitization for Intellect Digital Core implementation at Janata Bank

Ranked number 1 for Retail Lending in IBS Annual Sales League Table 2022

CBX Retail Digital Onboarding wins XCelent Functionality Award 2020

Ranked number 1 for Product Breadth in IBS Annual Sales League Table 2022

Regional Leader (ASEAN) in IBS Annual Sales League Table 2022

Capital Cube is rated as Category Leader in the FinTech Quadrant for portfolio management platforms, 2021

Capital Cube is rated as Best of Breed in the RiskTech Quadrant for LRM solutions, 2021

Capital Cube is rated as Best of Breed in the RiskTech Quadrant for FTP solutions, 2021

Capital Cube is rated as Best of Breed in the RiskTech Quadrant for ALM solutions 2021

Ranked number 1 for Retail Banking for the sixth consecutive year in Annual Sales League Table 2022

Intellect has been recognized among global suppliers of Treasury and Capital Markets systems in the IBSi 2021 Read More

YES BANK adjudged winner at IDC Financial Insights Innovation Awards 2021 for Intellect powered Credit Origin Read More

Digital Core and Cater Allen bank adjudged winner in the IBSi NeoChallenger Bank Awards 2021 - Europe Region

Best Retail Payments System implementation at Janata Bank in IBS Global Fintech Innovation Awards 2021

Know More