eMACH.ai

Islamic Core Banking

AI-native. Shariah by Design. Composable by Architecture. Comprehensive by Coverage.

Recognised and supported by regulators and financial institutions across 45+ countries

AAOIFI-compliant Islamic core with enterprise deployments and a future-proof technology foundation.

eMACH.ai Islamic Core Banking is a cloud-native, microservices-based platform purpose-built for Islamic banking. The solution embeds Shariah rules into product and transaction flows so banks can demonstrate Shariah integrity and audit confidence. The platform seamlessly supports pure Islamic banks, Islamic windows, and dual-banking models, enabling real-time, 24/7 Retail, SME, and Commercial banking operations. The platform includes a headless Digital Engagement Platform with composable journeys and AI-enabled personalization. Developed, implemented and supported by Intellect, eMACH.ai helps banks launch faster and operate with confidence.

Programar una reunión

Performance that Powers Growth

01

Business Growth

Quick Go To Market (GTM)

Built on microservices architecture which can be assembled and configured

Composable solution

Comprehensive breadth & depth of functionality integrated product suite covering Islamic Accounts and Deposits, Islamic Pool Management, Islamic Financing, Cards and Mobile banking

02

Future Proof Technology & Architecture

Accelerate change and drive innovation with a containerized Core Banking platform that offers adaptive scalability based on business volumes

Ensuring seamless integration with Digital channels & external systems

Extensibility – Reducing Customization

Open API availability & easy integration

Straight Through Processing through easy workflow & orchestration (Do-It-Yourself)

Low code no code platform for IT users to extend capabilities without deep engineering effort, fostering faster time-to-market

03

Risk, Regulatory and Compliance

To cater to unique Local & Regulatory requirements to meet Shariah Regulations

24X7 Availability

Established Regulatory and Shariah monitoring Framework

High Availability by design

End of Day (EOD) Performance

04

Digital growth & customer experience

Event triggers and APIs

Seamless integration with payments, KYC, fraud and fintechs

Dynamic segmentation for targeted offerings

Digital-first journeys that drive acquisition and retention

Comprehensive Islamic Banking Suite

eMACH.ai supports Retail, SME and Commercial banking with a complete, composable product suite.

Core Transaction

Engine

Islamic Pool

Management

Islamic Financing

Islamic Trade Finance

Islamic Treasury

Digital Engagement &

Platform

Cards

Pagos

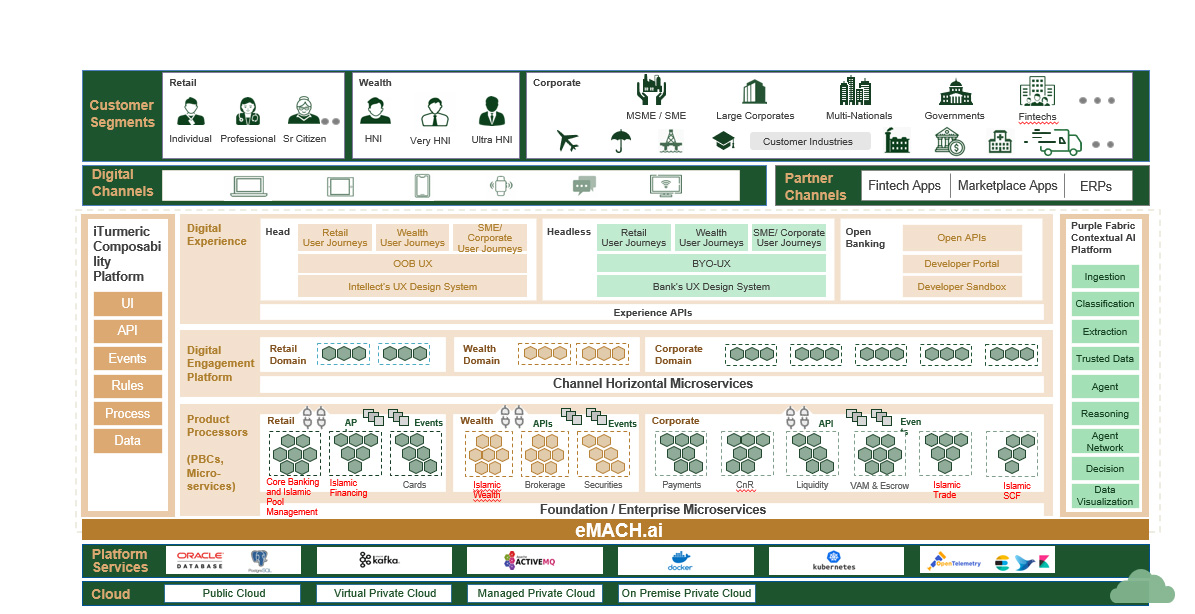

eMACH.ai – Cartographic Map Building the Architecture

Microservices-based, composable services and cloud-native

Database flexibility

AI enabled DEP

Built-in Shariah audit traceability

Composable Process Designer (iTurmeric ) for heterogeneous business components

Why choose eMACH.ai Islamic Core Banking

Shariah-by-design & AAOIFI-aligned

- Embedded AAOIFI-aligned Shariah rules

- Supports country-level configurability

Proven Co-Existence Framework

- Integración perfecta

- Low-Risk Modernization

- Real-time Data Sync

Flexible Product Designer

- No-Code/Low-Code Configuration

- Rapid Time-to-Market

- Highly Parameterized

Profundos conocimientos del sector

- 500+ clients across 60+ countries

- Dirección experimentada de bancos mundiales de primer nivel

- Mentalidad de socio de éxito a largo plazo

Diseño preparado para el futuro

- Composable eMACH.ai architecture powering Composability

- API abiertas que permiten ecosistemas conectados

Explora.

Aprende.

Innova.

-

Virtual Masterclass on AI-First Lending with PF Credit

EventosFebrero 27, 2026 -

Intellect Unveils the Next Wave of Banking with the Launch of eMACH.ai AI-First Banking at India AI Impact Summit 2026

NoticiasFebrero 19, 2026 -

Empowering Members: Kindred Credit Union’s Journey of Purpose-Driven Digital Banking Innovation

NoticiasFebrero 19, 2026

Preguntas frecuentes

Frequently Asked Questions

Our platform is designed with AAOIFI principles embedded at the core and allows other regulations to be configured as needed. Every transaction is executed within approved Shariah contracts and automated checks prevent Riba, Gharar and prohibited income. Built-in audit trails, controls and continuous validation ensure compliance is enforced throughout the entire transaction lifecycle from initiation to settlement.

The solution supports Mudarabah, Wadiah and Wakala investment products, providing full lifecycle handling from account setup to profit allocation. Native support ensures accurate accounting, reporting and operational workflows without bespoke adaptations.

We support Murabaha, Ijarah, Tawarruq, Istisna’a, Musharakah and Qard Hasan contracts with end-to-end contract management, booking, accounting and settlement capabilities. These contracts are implemented as first-class product templates to ensure consistent, Shariah compliant execution.

The platform includes a robust profit calculation and distribution engine that supports multiple profit pools and both periodic and event-driven profit calculations. It automates profit allocation between the bank and customers and delivers transparent P&L distribution with clear visibility for both the bank and the customers.

Yes, the platform supports Islamic banking alongside conventional banking on a single core while enforcing strict logical and accounting segregation. This enables simultaneous operation with independent product rules, accounting treatments and compliance controls for each model.

The platform is highly configurable to accommodate different Shariah board rulings, regional regulatory requirements and country-specific product variations. Contract parameters, profit methodologies and business rules can be tailored through configuration- no code changes required, so banks can align with local interpretations and market practices.

We provide end-to-end Shariah governance capabilities including full audit trails for all transactions, Shariah review and approval workflows, exception reporting and compliance dashboards. The system also supports internal and external Shariah audits, ensuring transparency, accountability and continuous oversight without manual intervention.

Our eMACH.ai architecture shifts focus from heavy coding to a composable, configuration-driven approach: Shariah-compliant contracts act as modular low-code Product Factory. Built on microservices and a headless, API-first design, it provides pre-built connectivity to the Islamic fintech ecosystem and removes prolonged integration bottlenecks, dramatically accelerating product launch cycles.

The platform includes built-in regulatory reporting and control frameworks that can generate regulator-ready reports and apply rule updates through configuration. This lets banks adapt quickly to evolving compliance requirements while minimizing operational effort and risk.

Our differentiators are clear: a purpose-built Islamic banking product following AAOIFI guidelines; a fully composable, end-to-end customer lifecycle; microservices, cloud-native architecture with AI embedded; and direct ownership and implementation expertise. Backed by experience across 50+ countries and tier-1 banks, we deliver proven domain knowledge and a turnkey solution for Shariah-compliant banking. This enables banks to scale confidently whil staying aligned with Shariah and regulatory expectations.

Our platform provides Zakat as a configurable functionality. The module calculates liabilities, automates collection and routing to approved recipients and maintains full Shariah audit trails and reporting- all configurable to local policies and customer opt-in settings.

The Pool Management module computes net pool income and produces distributable profit schedules, supporting multiple pools, periodic or event-driven calculations and adjustments (fees/losses). Unlike many banks that still rely on manuals/spreadsheets, our engine automates calculation → allocation → accounting → reporting with traceable audit logs, giving transparent visibility of what profit will be paid and when.