What is Core Banking?

The clock is ticking for traditional banks. In an era where a few taps on a smartphone can open a new account, the multi-day processes of legacy banking systems are not just inefficient, they’re a liability. Banks are under immense pressure to deliver innovative, hyper personalised products and services that meet the increasingly demanding needs of modern customers. For many incumbent financial institutions, their core banking solution is an outdated, monolithic legacy system that serves as a significant barrier to innovation and growth.

This guide provides a comprehensive overview of modern core banking, its evolution, the challenges posed by legacy systems, and the transformative power of modern, AI-driven solutions like Intellect’s eMACH.ai Core Banking

Core Banking

Core banking is the back-end software that manages a financial institution’s mission-critical operations—deposits, loans, payments, and transactions. It acts as the single, unified database that holds all customer information and transaction history.Before core banking modernisation, each branch operated as an independent silo, making even simple cross-branch transactions slow and manual. The introduction of centralised core banking software revolutionised the industry by ensuring data consistency, accuracy, and real-time updates across all channels, branch, mobile banking apps, ATMs, and digital portals.

A modern core banking solution typically includes a suite of essential components and features:

- Single View of Customer: A 360-degree, unified view of every customer’s relationship with the bank, providing instant access to their complete financial history and profile.

- Real-Time Processing: Transactions are processed instantly, ensuring that account balances and data are always current, regardless of the channel used.

- Digital Connectivity: The system is built to seamlessly integrate with and power various digital channels, including mobile apps, online portals, ATMs, and more.

- Automated Processes: It automates routine and repetitive tasks like loan processing, account opening, and interest calculations, reducing manual errors and freeing up staff for more complex, customer-facing activities.

- Modular Architecture: The system is built with flexible, independent components that can be easily added, updated, or replaced, allowing banks to quickly launch new products and services.

Advantages for Commercial and Consumer Banking

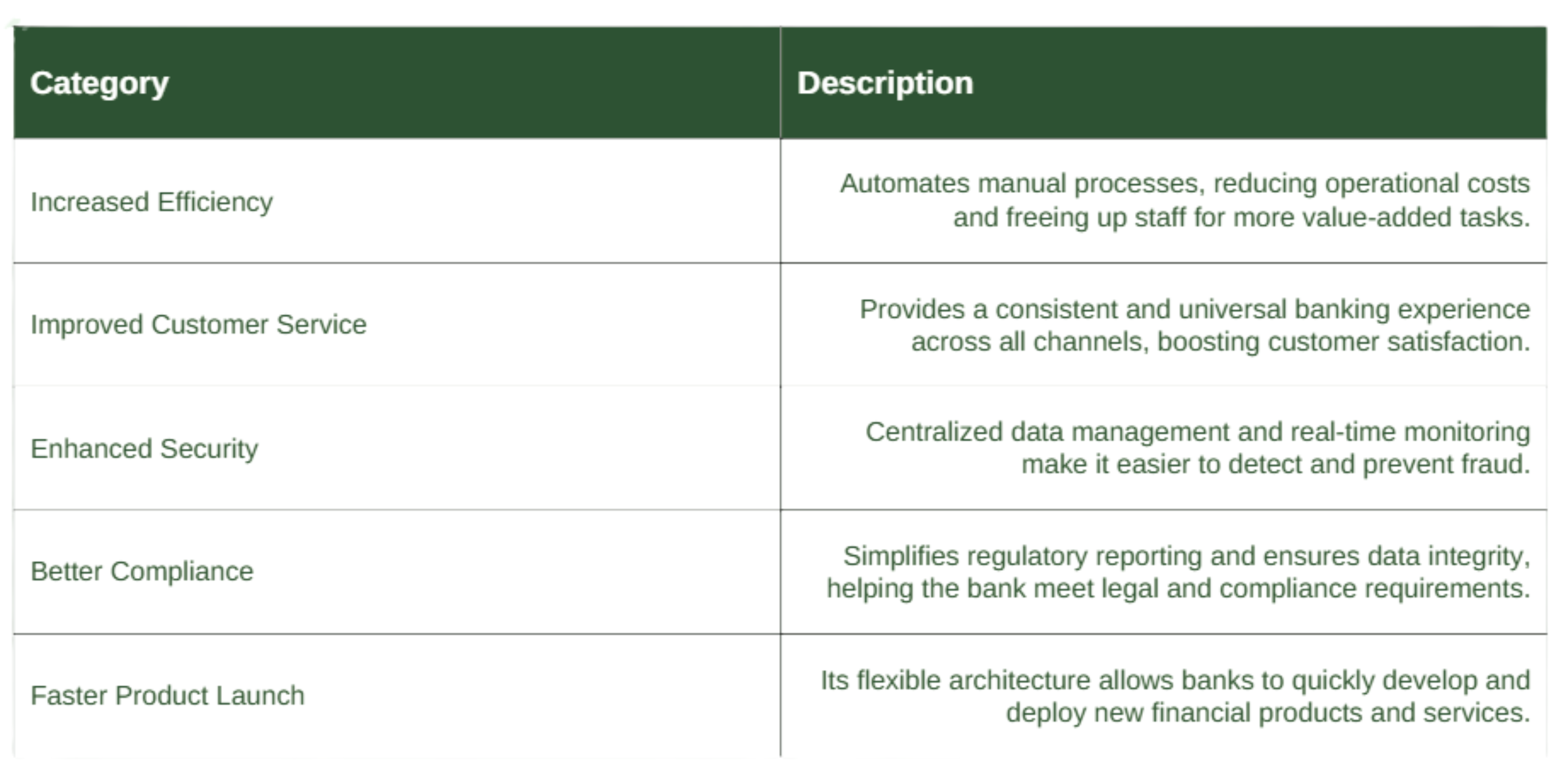

Implementing a modern core banking solution offers distinct benefits for both financial institutions and their customers, fundamentally transforming operations and enhancing the banking experience.

Core banking solutions bring distinct benefits to both financial institutions and their customers.

For Commercial Banking:

- Increased Efficiency: Automated processes and centralised data drastically reduce manual labour, speeding up everything from loan origination to account management. According to a report by EY1, banks can realise 20%-35% gains in operational efficiency through core modernisation, primarily from real-time processing and automation.

- Reduced Operational Costs: Less manual intervention and streamlined workflows lead to significant cost savings. Gitnux Research2 indicates that banks spend roughly 78% of their IT budgets on maintaining legacy core systems, a cost that is dramatically reduced by modernising.

- Enhanced Risk Management: The ability to monitor transactions in real time and have a single view of all data makes it easier to detect and prevent fraud, ensuring better compliance with regulations.

- Faster Product Development: A flexible core system allows banks to quickly design and launch new financial products and services to stay competitive.

For Consumer Banking:

- Seamless Convenience: Customers can perform banking activities from any location or channel—be it a different branch, an ATM, or an online portal—with consistent and up-to-date information.

- Faster Service: Real-time processing means transactions, like fund transfers and bill payments, are executed instantly.

- Personalised Experience: With a comprehensive view of the customer, banks can offer more personalised products and better customer support.

Implementing a modern core with Intellect’s eMACH.ai Core Banking solution

The future of core banking is defined by intelligent, adaptive technologies, with the next generation of solutions built on cloud-based, AI-driven platforms. Intellect’s eMACH.ai Core Banking solution embodies this future. The name eMACH.ai stands for Events-driven, Microservices-based, API-enabled, Cloud-native, and Headless architecture with underlying Artificial Intelligence models. This cloud-native core banking microservices architecture allows for unmatched scalability and agility.

Here’s how AI in core banking for personalisation is transforming the landscape and how eMACH.ai leverages these advancements:

- Hyper-Personalisation: AI and machine learning models analyse transaction data, spending habits, and customer behaviour to offer highly personalised products and services, such as a loan tailored to a customer’s specific needs.

- Enhanced Security: AI-powered fraud detection systems analyse patterns in real-time, identifying and flagging suspicious activities with greater speed and accuracy than traditional rule-based methods.

- Automated Processes: AI automates and accelerates complex processes like loan underwriting, enabling faster and more accurate credit decisions. This demonstrates the power of automated underwriting with AI in banking.

- Conversational Banking: AI-enabled chatbots and virtual assistants can handle a wide range of customer queries and basic transactions, providing instant, 24/7 support and reducing the workload on human staff.

- Future-Proof Architecture: The eMACH.ai platform’s composable, microservices-based architecture allows banks to quickly adapt to new market demands, integrate with fintech partners via open APIs, and innovate without completely overhauling their system.

The future of banking is here, and it’s built on a foundation of agility and intelligence. Don’t let your legacy systems hold you back. Intellect’s eMACH.ai Core Banking is a strategic investment in a unified, agile, and future-ready foundation that positions financial institutions for sustainable growth and a customer-centric future.

Ready to see how eMACH.ai Core Banking can transform your bank?

Frequently Asked Questions (FAQs)

1. What is the difference between core banking and digital banking?

Core banking is the back-end system that handles a bank’s fundamental operations (e.g., ledgers, accounts, transactions). Digital banking refers to the front-end channels (e.g., mobile apps, online portals) that customers use to interact with the bank. A modern core banking system is essential for a seamless digital banking experience, as it provides the real-time data and processing power that digital channels rely on.

2. Why are banks moving away from legacy core banking systems?

Legacy systems are typically monolithic, outdated, and difficult to update. They often run on older programming languages, making them slow, costly to maintain, and unable to integrate with modern technologies like AI and cloud computing. This lack of agility makes it difficult for banks to innovate, launch new products, or compete with nimbler FinTechs.

3. How does a modern core banking system help with customer experience?

A modern core banking system provides a 360-degree view of the customer, enabling banks to offer highly personalised products and services. Its real-time processing ensures transactions are instant and accurate, while its modular architecture allows for the quick launch of innovative features. This combination of personalisation, speed, and continuous innovation leads to a superior and more satisfying customer experience.

4. How does Intellect’s eMACH.ai Core Banking solution differ from traditional systems?

eMACH.ai is built on a cloud-native, microservices-based architecture, making it highly flexible and scalable. Unlike legacy cores, it is API-enabled, event-driven, and powered by AI, allowing banks to:

- Launch new products in weeks, not months

- Automate processes like loan underwriting with AI

- Deliver hyper-personalised banking experiences

- Integrate easily with fintech ecosystems