Coopératives de crédit

Créer une expérience numérique de haut niveau

sans limiter la touche personnelle

Empowering Lifestyles for

Credit Union Members (en anglais)

Au cœur de chaque coopérative de crédit se trouve la mission de servir les membres avec soin, intégrité et innovation. L'iGCB comprend les défis uniques auxquels vous êtes confrontés - créer des liens significatifs tout en stimulant la croissance, en gérant les coûts et en atténuant les risques. Nos solutions permettent aux coopératives de crédit d'approfondir les relations avec les membres grâce à des expériences personnalisées et transparentes, de débloquer de nouvelles sources de revenus grâce à des services modernisés, d'optimiser l'efficacité opérationnelle pour contrôler les coûts et d'aborder les risques de manière proactive grâce à des outils intelligents et intégrés. Ensemble, nous pouvons réimaginer l'avenir de votre coopérative de crédit, où chaque interaction renforce la fidélité, favorise la croissance et garantit le succès à long terme.

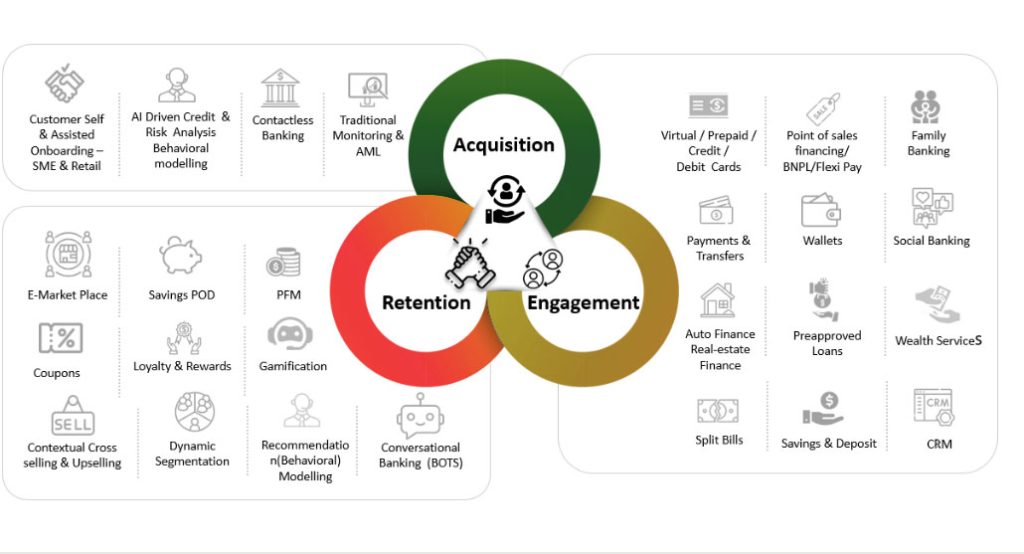

Une seule plateforme - 3600 Engagement

La meilleure solution pour les coopératives de crédit

eMACH.ai DEP

Digital Engagement Platform unifiée qui aide les banques et les coopératives de crédit à offrir un engagement continu et contextuel tout au long du cycle de vie du client, de l'acquisition à la fidélisation en passant par l'engagement.

Ce que disent nos clients

Transformer les défis de

en réussites de

Étude de cas : Une banque de premier plan en Tanzanie améliore l'expérience client et les revenus grâce à la transformation des canaux de base, de prêt et numériques.

Onboarding de 3 minutes pour les clients du commerce de détail, réduit de 15 à 4 étapes

Ouverture de compte en 10 minutes contre 1 à 2 heures plus tôt

Plus de 2000 paiements quotidiens, capacité de traitement accrue par agence

Étude de cas : L'autonomisation financière innovante grâce à des solutions de paiement avancées

Étude de cas : Une grande banque du Zimbabwe s'associe à l'iGCB pour transformer le Core Banking

Étude de cas : Permettre à une grande banque indienne de lancer une expérience de carte exceptionnelle

Innovations primées

Classé n°2 dans le classement des ventes de l'IBSi pour 2024

Classé n°2 Digital Banking & Channels dans le Sales League Table d'IBSi 2024

La Digital Engagement Platform de l'iGCB(précédemment appelée CBX-R) a remporté le prix de la meilleure mise en œuvre de technologie omnicanale pour sa mise en œuvre à la Co-operative Bank of Kenya dans le cadre des Asian Banker Global Middle East and Africa Awards 2023.

La plateforme de banque numérique de l'iGCB- CBX Retail a reçu la mention 'Functionality Standout' dans le rapport de Celent intitulé 'Retail Digital Banking Platforms : International Edition".

CBX Retail Digital Onboarding remporte le XCelent Functionality Award 2020

Intellect Design Arena nommé acteur majeur dans IDC MarketScape : North America Digital Banking Customer Experience Platforms 2022 Vendor Assessment (doc #US48061122, March 2022)"

La plateforme de banque numérique CBX Retail de l'iGCBa reçu la mention " Functionality Standout " dans le rapport d'analyse ABC de Celent intitulé " Retail Digital Banking Platforms North America Edition - Solutions for Midsize and Large Banks " (Plateformes de banque numérique de détail édition Amérique du Nord - Solutions pour les moyennes et grandes banques).

Explorer.

Apprendre.

Innover.

-

Webinar: Acquire & Retain Customers Digitally – at 30% Lower Cost

EvénementsJune 19, 2025 -

First Abu Dhabi Bank (FAB), UAE’s global bank, accelerates digital transformation with Intellect’s eMACH.ai Lending, setting new standards in debt management

ActualitésJune 16, 2025 -

Money20/20 Europe 2025

EvénementsJune 6, 2025