From fragmented systems to intelligent cores: The new architecture mandate for central banks and financial institutions

Across global financial systems, a deep architectural shift is underway. Central banks, once operating in predictable, linear environments are now anchored in an ecosystem defined by immediacy, interoperability, rapid innovation, accelerated AI adoption, tokenized assets & deposits and increased geopolitics, regional conflicts. These trends are changing the overall financial landscape including the cross-border transactions, capital markets, liquidity, velocity of the money in the economy and systemic risk.

Speed, cost, transparency, availability and scale are at the centre of the modern financial infrastructures that drive the nations, systemically critical institutions including the central banks and national/cross-border payment infrastructures and commercial banks.

India being a large and rapidly evolving economy illustrates this shift vividly: the country’s regulatory push toward real-time payments, supported by UPI and the broader digital public infrastructure stack, has transformed transactional behaviour at scale. UPI processed 131.2 billion transactions in FY24 (NPCI, 2024) and now peaks at 12,000+ transactions per second, meaning liquidity and settlement exposures oscillate continuously rather than once a day (1) (2). This real-time behaviour also extends to identity and cyber risk, where compromised credentials move rapidly across interconnected systems, more than 70% of cyber intrusions globally, now originate from identity compromise (Microsoft Digital Defense Report 2024) (3). RBI (Central Bank of India) now operates 24x7x365 with continuous clearing to support this shift in the financial landscape. (4)

Central banks across the world, however, still rely on architectures built for an earlier era, characterised by batch windows, siloed operations with manual interventions for many areas which otherwise can be fully/partially automated, and dated technology stack. The legacy operating model is increasingly misaligned with a financial ecosystem that operates without pause. The result is a structural tension: money, data, and risk now move in real time, while the underlying infrastructure still operates in overnight cycles. Also, a recent survey amongst central bankers across the continents for Intellect Oxford School of Central Banking thought leadership programme, reveals that a medium complexity policy implementation takes about 6 months for the implementation in the world revolving in real-time. 84% of central banks acknowledged that digital transformation is their highest priority while 49% of them indicated that addressing cybersecurity challenges is the priority (5).

ISO20022 alignment to G20 cross border payments goals of Cost (global payments avg. @1% and remittances @3%), Speed (75% within 1 hr and the rest within 1 day), Transparency, and access are further increasing the demand on the national and cross border infrastructures (6).

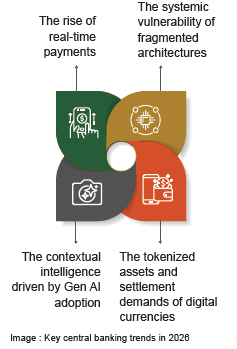

And this tension is being amplified by four converging shifts that are redefining the role and responsibility of central banks:

Together, these pillars explain why central banks must re-imagine their core architecture using first principles thinking to support the rapidly evolving landscape.

Speed is no longer an advantage. It is a default condition in which central banks must be able to survive.

1. The rise of real time payments

The global march toward real-time payments has fundamentally reshaped the expectations placed on central banks. India’s UPI processed 131.2 billion transactions in FY 2024 with a 20% year-on-year rise (NPCI, FY 2024). Brazil’s PIX handles more monthly payments than credit and debit cards combined. FedNow has pushed the United States into 24×7 instant clearing. The BIS now notes that over 91% of central banks are modernizing RTGS infrastructure to real-time settlement standards (BIS Payments Report, 2024) (7).

Real-time movement means real-time liquidity risk, real-time fraud patterns, and real-time supervisory expectations. Legacy core systems, designed around end-of-day reconciliation, were never intended for continuous settlement cycles.

As the pace of payments accelerates, the pressure on central banks is no longer just operational, it has become existential. In 2024, Stablecoins facilitated a staggering $27.6 trillion in payment transfers (surpassing the combined volumes of Visa and Mastercard) and as the velocity of money accelerates, it exposes the next challenge: fragmented systems that cannot respond as a unified whole (8). The on-chain data—transactions verified and recorded on a blockchain—suggest that about $250 billion of stablecoins have been issued. Tier-1 banks including JPMC are now jumping to launch tokenized deposits.

2. The systemic vulnerability of fragmented architectures

One of the most persistent vulnerabilities in financial infrastructure comes from fragmentation. When the market operations are not fully supported by real-time advanced collateral management, when security/fund settlement infrastructures are driven with manual intervention & reconciliation, when supervisory analytics are detached from settlement platforms, when government banking and reserves operations run on separate technology stacks, risk can propagate faster than alerts can surface.

This fragmentation is especially dangerous in cybersecurity. The Microsoft Digital Defense Report 2024 reveals that 74% of global intrusions originate from identity compromise, exploiting the gaps where one system ends and another begins. A breach or anomaly no longer stays confined to a particular function; it spreads laterally across systems that were never engineered to talk to each other in real time. Fragmentation may once have been a manageable inconvenience. In today’s architecture, it is a systemic risk and nowhere is this more evident than in the way artificial intelligence initiatives are impacted by legacy design/ecosystem.

3. The contextual intelligence driven by Gen AI adoption

AI should be best leveraged to re-imagine the business process instead of a bolt-on tool in the existing processes like Robotic Process Automation

GenAI and advanced analytics are entering the heart of central banks and commercial banks: predicting the currency requirements, forecasting policy scenarios, scanning market movements, detecting anomalies in payment data, and enhancing supervisory intelligence. But AI cannot thrive or even remain safe on fragmented or inconsistent datasets coupled with processes supported by siloed systems.

A successful AI implementation for a highly regulated banking industry requires a stronger AI solution that takes care of the triple constraints – cost/speed/accuracy, GDPR, Personal/sensitive data protection, comprehensive governance including a detailed track, trace and trail, auditing, prompt defense/toxicity management, comprehensive access control at various levels including the data/documents used to train the model or build the RAG. EU and US are actively working on the regulations to ensure safe/secure implementation of AI which includes EU AI Act. The similar initiatives are being taken across many countries.

Gen AI is likely to bring substantial shift to global economies in the coming years. Goldman Sach predicts that Gen AI is likely to add over 7% or 7 trillion dollars to global GDP in next 10 years (9). With big-techs investing hundreds of billions of dollars in LLMs and the data centers, this wave has pulled not only financial industry but pretty much all the industries into adopting the AI in their business to enhance the service delivery across the customer value chain. McKinsey expects about 70% reduction in certain cost categories and a 15% to 20% on the aggregate cost base for banks due to AI (10).

G7 regulators have signaled that AI-assisted supervisory tooling will become standard by 2026 and beyond. Yet AI models amplify response based on the environment in which they are placed. In a unified, well-governed data architecture, they accelerate insight. In a fragmented one, they magnify incoherence, creating false alerts or missing early signals.

This is why central banks are increasingly concluding that AI-readiness is not a feature, it is an architectural demand. This leads directly into the fourth pillar redefining the future core.

4. The tokenized assets and settlement demands of digital currencies

Across continents, central banks are rapidly advancing their experimentation with digital currencies. The BIS reports that 94% of central banks are researching or piloting CBDCs (BIS Annual Survey, 2024). Tokenized settlements, cross-border experiments, and hybrid models—where both account-based and token-based money coexist—are becoming more common.

The increased acceptance of Tokenized Asset and Deposits across the world over the last 1.5 years appear to have taken the momentum out of CBDC initiatives.

But the underlying truth is simple: traditional RTGS systems cannot natively support tokenized value. Nor can they execute programmable settlement or atomic delivery-versus-payment. Digital currencies do not merely introduce a new payment instrument; they redefine how central infrastructures must be designed.

These four pillars together make one truth unavoidable: incremental modernization is no longer enough. A new core is required.

Why incremental modernization falls short

Most central banks have spent the last decade modernizing – refreshing databases, renewing applications, layering APIs, and enhancing user interfaces. But modernization does not resolve foundational challenges:

- Batch processes cannot be converted into event-driven intelligence

- Siloed systems cannot be stitched into a coherent supervisory fabric

- Tokenized assets cannot be served from account-only ledgers

- Real-time settlement demands cannot be met by architectures built for overnight cycles

This is why a new category of central banking architecture is emerging, the intelligent core.

An intelligent core is not a collection of modules; it is an operating philosophy.

The rise of the intelligent core

An intelligent core is designed around principles that reflect the realities of the modern financial system:

- Data is unified, not distributed

- Processing is real-time, not periodic

- Human in loop for enhancing operations, not for running the entire operation manually

- Recon is built-in, not a mandatory evil

- Security is zero-trust, not perimeter-based

- Services are decomposed, not monolithic

- AI is embedded, not bolted

- Currency is hybrid – account-based and token-based

- Interoperability is built-in, not customized

This is the architecture that allows central banks to sense, interpret, and act at the speed of the modern economy.

A natural transition: From architecture theory to architecture reality based on First Principles Thinking

As central banks look to migrate from fragmentation to intelligent architecture, they require platforms that embody these principles organically not through customization, but through native design.

This is where purpose-built platforms like Intellect’s eMACH.ai Core for Central Banks become relevant, not as software products, but as architecture enablers engineered specifically for central banking.

eMACH.ai Core for Central Banks supports the breadth and depth of central bank functions including banking services, government services, government payments, currency lifecycle management, reserve portfolio management, collateral and market operations/monetary policies management, govt. debt management, secondary market trading and settlement, enterprise general ledger, and CBDC settlement, within one architectural fabric designed for progressive transformation.

Intellect eMACH.ai Core for Central Banks helps Central Banks to significantly improve both financial and operational efficiency. Quantum delivers a host of tangible benefits including:

- Full reconciled real-time balance sheet with General Ledger to transaction navigation

- Over 250 digital services for banks, ministries, govt. agencies and currency chests through specially designed online portal

- Comprehensive support for wide range of monetary policy tools including advanced collateral management

- Treasury Single Account (TSA) with real-time balance consolidation

- Govt. payment gateway to process the govt. benefits, salaries and supplier payments at scale

- Robust currency in circulation management real-time tracking at the national level

- Zero-trust security architecture by design

And critically, its underlying architecture is event-driven, API first, cloud-agnostic (public/private clouds), composable, with in-built business impact AI framework. In essence, eMACH.ai Quantum represents the architectural pattern central banks are increasingly moving toward, one where intelligence is unified and built into the core.

A strategic imperative for the next decade

The next decade will be defined not only by policy choices, but by architectural choices. CXOs across central banks are now evaluating infrastructure through a new lens:

- Can risk be identified systemically, not in fragments?

- Can liquidity be monitored in real time, not at end-of-day?

- Can AI operate safely across the enterprise, not in isolation?

- Can digital currency coexist with traditional money without friction?

- Can supervisory visibility match the speed of the financial ecosystem?

These questions no longer belong to technology teams, they belong to leadership.

The new mandate for central banks is simple: transformation the central bank infrastructure that is nimble, flexible, real-time, fully-integrated with embedded AI

Closing reflection

Fragmented architectures are incompatible with real-time finance. Intelligent cores are not optional upgrades, they are the institutional foundation for monetary stability, digital currency innovation, cyber-resilience, and supervisory excellence.

Central banks that embrace this architectural shift will not only keep pace with the modern economy, they will shape it.

Author

Selvakumaran S

EVP & Partner, Central and Consumer Banking, Intellect Design Arena

Curriculum Director, Intellect Oxford School of Core Banking