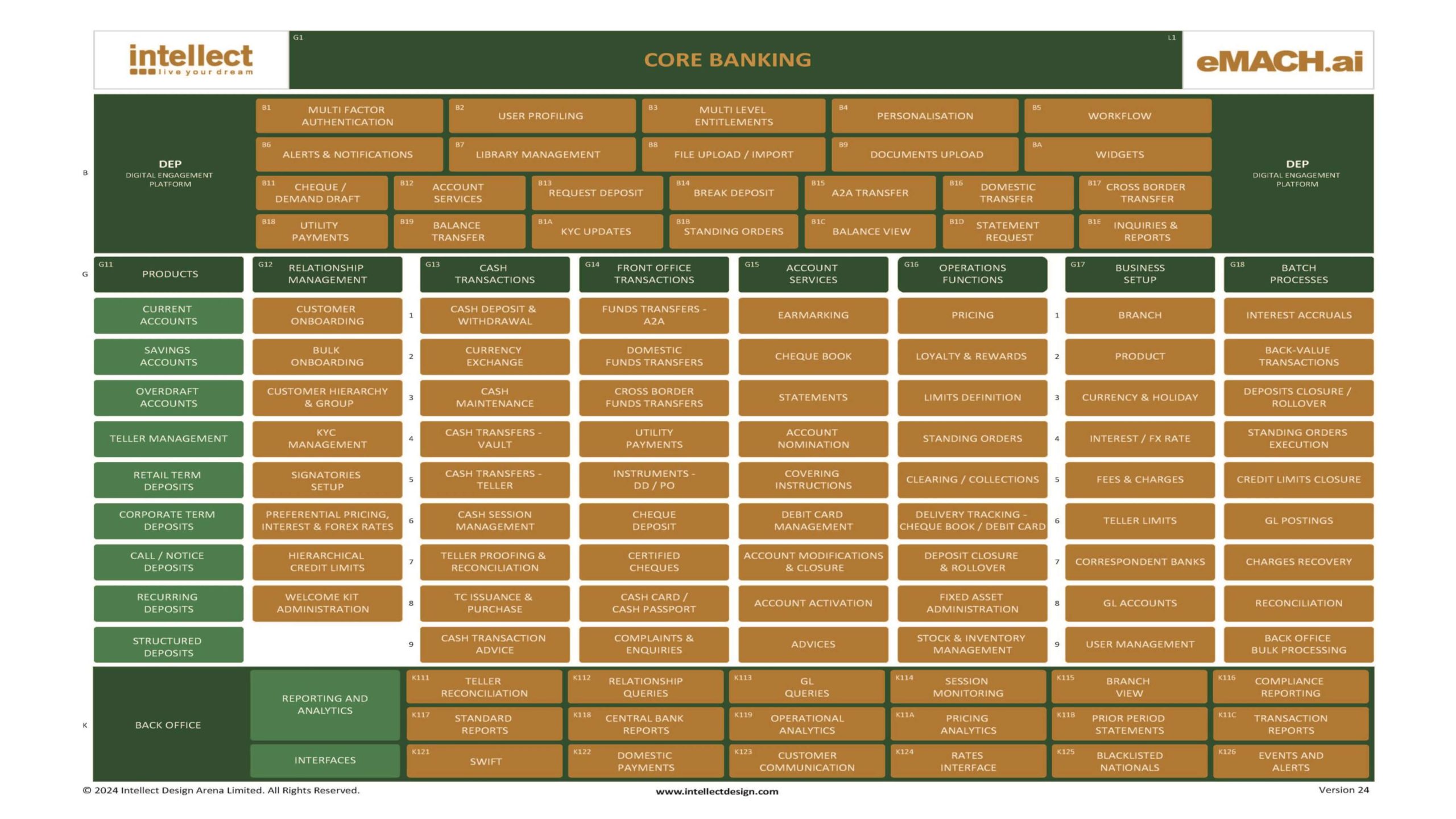

eMACH.ai

Core Banking

Comprehensive core banking platform helping Banks grow business, improve customer experience and reduce risk.

Ranked Number 1 in Retail Banking

In a rapidly evolving financial landscape, staying ahead requires a core banking platform that is as dynamic and innovative as your ambitions. eMACH.ai Core Banking is a unified platform meticulously designed for Retail, SME, and Commercial banks. eMACH.ai Core Banking’s comprehensive product suite, built on a robust cloud-native microservices architecture, delivers unmatched scalability and flexibility, effortlessly adapting to meet the demands of an ever-changing market. Its Open Finance capabilities unlock access to country-specific marketplaces, ensuring global readiness. Seamless integration is paramount; eMACH.ai Core Banking’s headless architecture ensures smooth interoperability with any digital banking platform, including iGCB’s own Digital banking platform, thereby future-proofing your operations.

eMACH.ai Core Banking goes beyond traditional banking with embedded AI-driven customer journeys, making them more intuitive. This powerful combination allows your institution to deliver bespoke, innovative solutions tailored to the unique needs of modern clients.

Schedule a Meeting

Modern Core, Limitless Possibilities

01

Accelerate Business Growth

High flexibility with a composable architecture and easy orchestration using API & Events

Reduce development costs through parameterization & customer extensibility kit

Configure new products with DIY Product Configurator & Product Templates

Drive efficiency with AI-based automated processes & rule-based STP

02

Improve Customer Experience

Integrate with digital banking and other systems to deliver personalised customer experience through Open APIs

Onboard new credit customers, disburse and manage loans digitally with a credit platform

Onboard customers and provide personalised experience through a unified Digital Engagement Platform

03

Reduce risk Focus

N-Tier Real-time General

Ledger

Experience faster go-to-market with minimal disruption in data migration

Comply with local regulations with a country-ready core banking platform

More control of implementation with on-site Intellect implementation team

Jumpstart with

Our Comprehensive

Offerings

Current &

Saving Account

Lending

Deposits

Trade Finance

Cards

Digital Banking

Payments

Treasury

Preferred Core Banking Platform for top banks globally

Built on the revolutionary eMACH.ai architecture

Microservices-based architecture with Composable processes, Business Components, Open Data Models and Open Services enabling agility

Scalable to Multi-cloud, multi-country, multi-entity, multi-branches, multi-lingual, and multi-currency

Composable Process Designer (iTurmeric ) enables the composability of heterogeneous business components across the ecosystem

Customization and Extensibility Kit allows customisation based on user roles

Why Choose

eMACH.ai Core Banking?

Future-proof design

- Composable eMACH.ai architecture

- Open APIs allowing connected ecosystems

Quick go-to-market

- Comprehensive coverage of business components

- Low code-no code composable process designer

In-depth domain knowledge

- 325+ clients across 57+ countries

- Experienced leadership from tier 1 global banks

Customer-centric culture

- Nimble & agile culture with an entrepreneurial mindset

- Commitment to joint innovation

- Long-term success partner mindset

Higher ROI

- Adaptive commercial model

- Risk-sharing approach

What Our Clients Say

Transforming

Challenges into

Success Stories

Case Study: A leading bank in Zimbabwe partners with iGCB to transform Core Banking

100 business days

support over 11,500 transactions per second

200% increase in transaction processing capacity

Case Study: Utkarsh Small Finance Bank goes live with comprehensive core banking

Case Study: Driving Digital Transformation for a subsidiary of Santander UK

Case Study: Transforming Sonali Bank’s Core Banking

Award-Winning

Innovations

Intellect Design Arena Played a pivotal role in shaping two of Forrester’s latest Trends and Vision reports on the present and future of Digital Banking Experiences

Ranked no.1 Retail Banking in IBSi Sales League Table 2025

Ranked no.2 in NORTH AMERICA REGIONAL in IBSi Sales League Table 2025

Ranked no.3 in GLOBAL LEADERSHIP CATEGORY in IBSi Sales League Table 2025

Recognized as a Leader in three quadrants and Best-of-Breed in one quadrant in Chartis’ RiskTech Credit Risk Management Solutions 2025 Quadrants report

Rated as a Leader in ‘The Forrester Wave Digital Banking Processing Platforms for Retail Banking, Q3 2022’

Intellect Ranked No. 3 in Global Leadership – Geographic spread in IBSi Sales League Table 2024

Explore.

Learn.

Innovate.

FAQs

What are the key factors banks should consider while choosing eMACH.ai Core Banking?

Banks should consider scalability and performance, speed to market, open ecosystem, domain & market expertise, delivery expertise & technology provider’s cultural fitment as some of the factors while choosing a core banking technology provider. eMACH.ai Core Banking is a leader in core banking with proven expertise in all these metrics.

How does the eMACH.ai Core Banking platform help reduce operational costs?

eMACH.ai Core Banking achieves cost efficiency by:

● Automating workflows, reducing manual intervention, and improving accuracy

● Leveraging rule-based engines for pricing, transaction monitoring, and credit origination

● Offering a Pay-as-you-grow model, ensuring cost alignment with business scale

Can eMACH.ai Core Banking help with Open Banking compliance?

Yes, the platform is fully compliant with Open Banking and Open Finance standards. It provides extensive APIs that enable seamless integration with fintech partners, marketplaces, and third-party systems, ensuring banks can harness the power of an interconnected financial ecosystem.

How does eMACH.ai Core Banking improve the customer experience?

eMACH.ai Core Banking comes with eMACH.ai Digital Engagement Platform (DEP) which helps banks onboard customers digitally within minutes. The platform also helps banks provide all banking (loans, payments, deposits, investments), engagement (PFM, Loyalty, rewards) and beyond banking (ESG, wallets, SuperApp) all in one platform across channels.

How secure is the eMACH.ai Core Banking platform?

eMACH.ai Core Banking incorporates advanced security features, including:

● AI/ML-driven fraud detection for proactive risk management

● Compliance with global regulatory standards, ensuring secure operations

● Continuous monitoring and real-time alerts to mitigate risks effectively