eMACH.ai

Lending

Unleash the Power of Digital Credit. Limitless Credit Solutions.

Built for a Boundary-less World

Ranked #1 in Digital Lending for delivering innovative solutions & measurable results

eMACH.ai Lending is a cutting-edge digital credit management system designed to meet the evolving needs of credit seekers and financial institutions. Empowering FIs to offer both commoditized and specialized credit products across Retail, Corporate, SME, and Agri segments, eMACH.ai Lending ensures a seamless, efficient approach to the digital credit landscape.

With the ‘Always On, Always Aware’ concept, eMACH.ai Lending enables real-time, informed credit decisions, providing banks with a 360-degree view of customer portfolios. The DIY model allows banks to create products on-the-fly, ensuring flexibility. The fully automated, robust architecture drives enhanced operational efficiency, reducing costs. eMACH.ai Lending integrates Credit Origination, Loan Servicing, Debt Management, and Collateral & Limits Management, with each component also available as standalone products, supporting digital credit transformation at every stage.

Schedule a Meeting

Transforming Credit Management

01

Accelerated Credit

Origination

Achieve 3x growth in origination volume,

enabling faster customer acquisition

Seamless API onboarding

& documentation

02

Comprehensive Credit

Lifecycle Management

Manage everything from credit origination

to servicing, collections, and delinquency

Gain a 360-degree view of borrower exposure, ensuring better credit decisions

03

Built on Future-Ready

Architecture

Proven capability to handle 10,000+ TPS with real-time event streaming

Cloud-ready platform supporting on-premises, public, and hybrid deployments

04

Empowered Risk

Mitigation

Intelligent underwriting powered by AI ensures faster and more accurate decisions

Real-time margin tracking and multi-dimensional exposure views minimize credit risks

Preferred Digital Lending solution for top banks globally

Revolutionizing Lending Operations

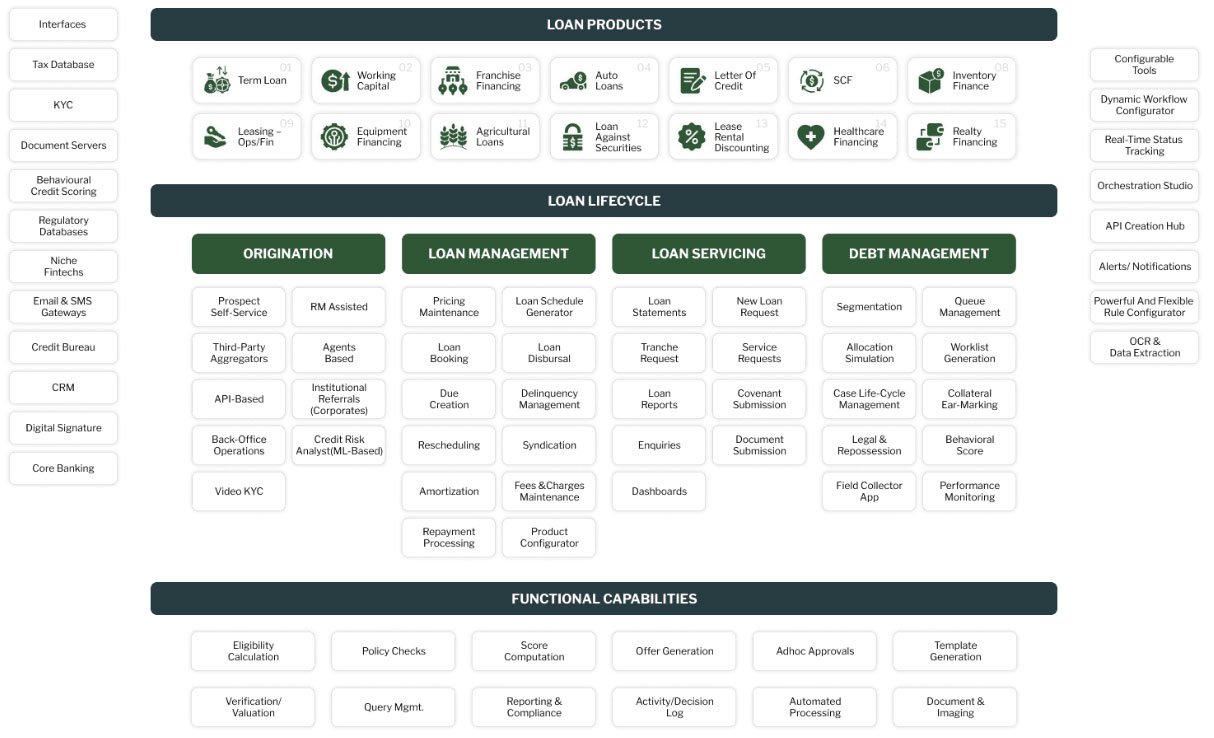

eMACH.ai Lending – Overall Architecture

Diverse loan products

Comprehensive loan lifecycle management

Integration of functional capabilities

Why choose

eMACH.ai Lending?

Seamless Onboarding Experience

- Omni-channel origination with customer initiated/ RM assisted journeys

- API-based origination enabling collaboration with fintechs

- Digital data aggregation through structured and unstructured data sources

- Zero touch documentation enabled by digital signatures

Accelerate Growth with Scalability

- Proven to handle 10 million+ accounts and process thousands of transactions per second

- Cloud-native platform ensures seamless scalability across geographies and business segments

Future-Ready Architecture

- Built on MACH principles (Microservices, API-first, Cloud-native, Headless) for unmatched flexibility

- Real-time data streaming and embedded AI enable dynamic decision-making and operational efficiency

Comprehensive Credit Ecosystem

- Integrate seamlessly with fintechs, credit bureaus, and third-party systems via 1,200+ APIs

- Modular design allows independent deployment of components, ensuring progressive modernization

Minimize Credit Risks

- Centralized real-time monitoring across varied lines of business

- Multi-dimensional exposure view

- Single view of borrower’s exposure across multiple levels

- Real-time margin tracking

Maximize Collections

- Real-time loan performance analysis

- Personalized follow up

- Intuitive collection score for segmentation

- Customer-centric strategies and streamlined collection processes

What Our Clients Say

Transforming

Challenges into

Success Stories

Case Study: Intellect fuels aggressive growth for YES Bank, a leading private sector bank in India

50% reduction in loan processing time

100% digital onboarding for MSME customers

Powered on-the-go approvals, slashing approval times by 30% for preferred business lines

Case Study: Leading Private Sector Bank in India transforms its loan origination & credit card solution

Case Study: Bank implements Intellect Collaterals and Limits Management System across Asia Pacific and Europe

Award-Winning

Innovations

Intellect Ranked No. 3 in Global Leadership – Geographic spread in IBSi Sales League Table 2024

Intellect Ranked No. 2 among Regional Leaders in North America in IBSi Sales League Table 2024

Ranked No. 2 Islamic – Retail Lending in IBSi Sales League Table 2024

Ranked No. 1 Retail Lending in IBSi Sales League Table 2024

Ranked number 1 for Retail Lending in IBS Annual Sales League Table 2022

Ranked number 1 for Product Breadth in IBS Annual Sales League Table 2022

Regional Leader (ASEAN) in IBS Annual Sales League Table 2022

Explore.

Learn.

Innovate.

FAQs

How does eMACH.ai Lending empower financial institutions?

eMACH.ai Lending provides a fully automated, all-in-one lending platform. It integrates origination, servicing, and debt management, enabling FIs to offer seamless, real-time, and efficient credit services.

What is unique about the 'Always On, Always Aware' concept?

This concept ensures banks deliver real-time, digital-first solutions. It empowers banks to make informed credit decisions, enabling a 360-degree credit portfolio view for customers.

How does eMACH.ai Lending simplify exposure and collateral management?

Intellect’s CLMS provides real-time exposure and collateral monitoring with centralized asset tracking, ensuring a single source of truth for secured and unsecured credit exposures.

What types of credit products does eMACH.ai Lending support?

eMACH.ai Lending supports a range of credit products, including retail, corporate, SME, and agricultural loans, with flexibility for customization to meet diverse business needs.

How does eMACH.ai Lending reduce operational costs?

eMACH.ai Lending robust architecture automates workflows, minimizes manual interventions, and ensures efficient processes, resulting in significantly lower operational costs.