AI-first credit circuit: Reshaping the future of digital lending for the next decade

If you walk into any bank’s lending team today, you will find a mix of confidence and concern. Confidence because lending continues to be the engine of growth. Concern because the traditional ways are falling short as core expectations shift toward agility in disbursing loans, managing risk to control delinquency, and end-to-end operational efficiency.

Structural bottlenecks of modern credit

Data remains scattered across disconnected systems, forcing teams into constant manual reconciliation. This fragmentation creates a direct hit to operational efficiency and results in an inconsistent customer experience, eventually leading to a significant loss of business as applicants drop off. When the process relies on manual checks, long document reviews, and multiple sign-off layers, the institution faces frequent TAT bursts and a potential loss of opportunities as agile competitors move faster.

Service workflows often rely on redundant KYC and manual validation, increasing frustration for customers and lowers operational efficiency, as staff spend time on repetitive queries instead of high-value tasks.

Further, the current approach to loan operations and collections is fundamentally reactive, often identifying borrower stress only after a payment is missed. This delay drives high delinquency and weakens collection efficiency. Without the ability to spot early warning signs, the process focuses on damage control rather than proactive prevention, hurting both the customer experience and overall operational efficiency.

Emergence of AI in digital lending

According to the “The state of AI in 2025” survey report by McKinsey1, 88% of respondents regularly use AI in at least one business function, compared with 78% a year ago, indicating an increase in adoption. However, most organizations – approximately two-thirds are still in the early stages and have not yet scaled AI across their operations.

The shift toward AI and in digital lending is no longer just experimental; it is delivering measurable results. The consensus on Generative AI is even more striking—84% of senior credit risk leaders believe GenAI will drastically accelerate model development and deployment. Furthermore, 70% see it as the key to streamlining regulatory documentation, effectively shortening validation cycles that have traditionally been a major bottleneck.

Four foundational pillars of AI-first approach to lending

A successful enterprise AI implementation is built on four foundational stacks.

Image: Four foundational pillars of AI-first approach to lending

- The Enterprise Knowledge Garden ensures all enterprise-relevant data is curated, contextualized, and made accessible to AI agents for informed decision-making.

- Enterprise Digital Experts enable organizations to create and orchestrate intelligent AI agents that assist, augment, and automate operations across functions.

- The LLM Optimization Hub provides the flexibility to swap or integrate best-fit Large Language Models at any time, reducing vendor lock-in while optimizing accuracy, performance, and cost.

- Finally, Enterprise Governance establishes robust controls to govern and monitor AI agents and data, ensuring safety, auditability, and accuracy at scale. Together, these four stacks create a scalable, secure, and future-ready AI foundation for the enterprise.

Intellect’s approach to AI-based design for lending

AI is embedded in the operational DNA of digital lending rather than an add-on, forming the foundation of PF Credit. The platform is designed to deliver precision, explainability, and speed—going well beyond the capabilities of generic chat-based AI.

| AI capability | Impact on lending |

| Document processing | Document classification, extracting information from documents, validating information extracted and eliminating manual data entry. |

| Triangulation | Triangulation of data across multiple documents & sources to check for anomalies. |

| Statement analysis | Automated analysis for banking, income, expense and cash flow assessment. |

| Knowledge exploitation | Contextual Intelligence powered by AI agents to drive First Time Right (FTR) / First Time Not Right (FTNR), dynamic rule evaluations for policies & guidelines, scoring, in-principle approvals, validations, risk assessments, collection portfolio segmentation, etc leveraging the knowledge encapsulated in the Enterprise Knowledge Garden (EKG). |

| Artifact generation & decision support | AI-generated CAM (Credit Analysis Memos), Term sheets, Collection case insights, etc, providing real-time insights and recommendations. |

| Natural Language (NL) assistants | Assistants for various role players to provide information, insights and servicing |

Table: AI capabilities of PF Credit across the lending lifecycle

The platform enables continuous, risk-mitigated AI-native evolution using a Champion-Challenger model by allowing proven, structured pre-configured business rules (the “Champion”) to operate alongside knowledge-document–driven intelligence (the “Challenger”). Structured rules continue to provide stability and regulatory confidence, while AI-driven intelligence is applied to use cases such as FTR/FTNR determination, deviation analysis, and risk assessment. By running both approaches in parallel, banks can safely test, validate, and adopt more advanced AI-driven decisioning, ensuring controlled outcomes and a measured transition toward fully AI-native origination.

The platform follows a DIY (Do It Yourself) approach and enables banks for self-service, continuous innovation and improvements. For a bank, LLM selection and configuration, agent instructions, and institutional knowledge are all independently self-managed, allowing full control, flexibility, and faster iteration.

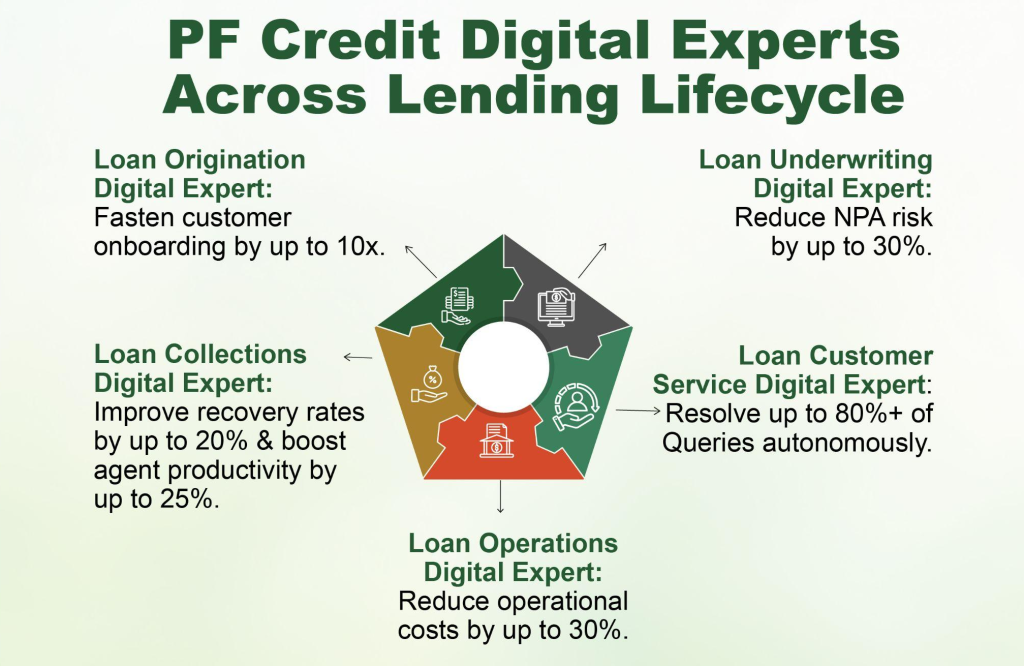

Digital experts in action

PF Credit digital experts are active participants that sit alongside lending teams, acting as a true capability booster and capacity multiplier.

Image: Digital Experts offered by Intellect’s PF Credit for banks

- In loan origination, the agents take over the heavy lifting of unstructured application sourcing and document extraction. This shift can lead up to a 60% reduction in manual data entry and works towards high accuracy of “First Time Right” (FTR). By acting as a dedicated assistant to both Relationship Managers and customers, it can eliminate the friction of the initial application and create a significantly smoother onboarding experience.

- For loan underwriting, the focus shifts to high accuracy of underwriter decisions, enhancing credit quality. The agent assists underwriters by performing complex case risk analysis and generates CAM summaries consolidating data from documents, and third party insights. This level of support reduces the constant back-and-forth typically required to finalize a file, resulting in faster decisions without compromising the accuracy or integrity of the risk assessment.

- In loan customer service, AI agents transform the borrower experience by acting as a 24/7 engagement channel. By serving as a dedicated assistant for loan enquiries, these experts can achieve up to 70% reduction in query resolution turnaround time (TAT). This efficiency directly reduces call center traffic and branch footfall, allowing the institution to provide instant, high-quality service at a much lower operational cost.

- Within loan operations, the role of the Digital Expert is one of proactive control. By functioning as a continuous portfolio scanner, these agents identify early warning signals and trigger events that human teams might miss. This proactive approach allows for a much tighter grip on delinquency risks and reduces overall operations costs, ensuring the portfolio remains healthy and well-monitored throughout its lifecycle.

- Finally, in loan collections, Digital Experts empower agent productivity through deep case insights and intelligent portfolio segmentation. These agents act as multilingual, context-aware communicators that can engage with customers more effectively, leading to improved collection efficiency and reduced provisions. By providing the right context at the right time, they ensure the collection process is both results-oriented and sensitive to the customer experience.

Closing Note

The shift toward an AI-first credit circuit is no longer a matter of “if,” but “how fast.” By moving beyond simple automation and empowering teams with specialized Digital Experts, financial institutions can finally break the cycle of manual bottlenecks and reactive risk management. This architecture, orchestrated by a hierarchy of intelligent agents, enables lenders to scale with a level of precision previously impossible.

As we look toward the next decade of digital lending, the competitive edge will belong to those who stop treating AI as a background tool and start deploying it as a strategic partner across every stage of the borrower journey.

Author

Viral Khandwala, EVP & Engineering Head – eMACH.ai Lending,

Intellect Design Arena Ltd