eMACH.ai

Treasury

Contextual Treasury Fueled by Composable NextGen Technology

Real-Time, Cross-Asset, Front-Mid-Back Office Treasury

eMACH.ai Treasury is a contextual cross-asset Treasury Management System, encompassing rich functionalities such as integrated front-mid-back office treasury, Asset Liability Management, portfolio risk analytics, reconciliation, constituent subsidiary general ledger, issuance & borrowings management, and FX trading. Powered by a cloud-ready architecture and API-first technology with SDKs for low code interfacing, it excels in building APIs and Services with a contextual and decoupled UI/UX.

Schedule a Meeting

Digitalize Treasury to Maximize Efficiencies

01

Real-Time,

Cross-Asset Treasury

Integrated front-mid-back office treasury solution with seamless trade lifecycle management across diverse asset classes along with advanced risk analytics (150+ metrics)

04

Compliance and

Liquidity Management

Manage Basel III risks, reduce liquidity requirements, and ensure IFRS compliance with contextual insights

Our Point Solutions

Contextual Asset Liability Management (CALM)

Automated Reconciliation & Reporting

Branch Foreign Exchange (Branch FX)

Contextual Banking Experience Foreign Exchange (CBX FX)

Resource Mobilization

Transforming Treasury to Automate Treasury Processes

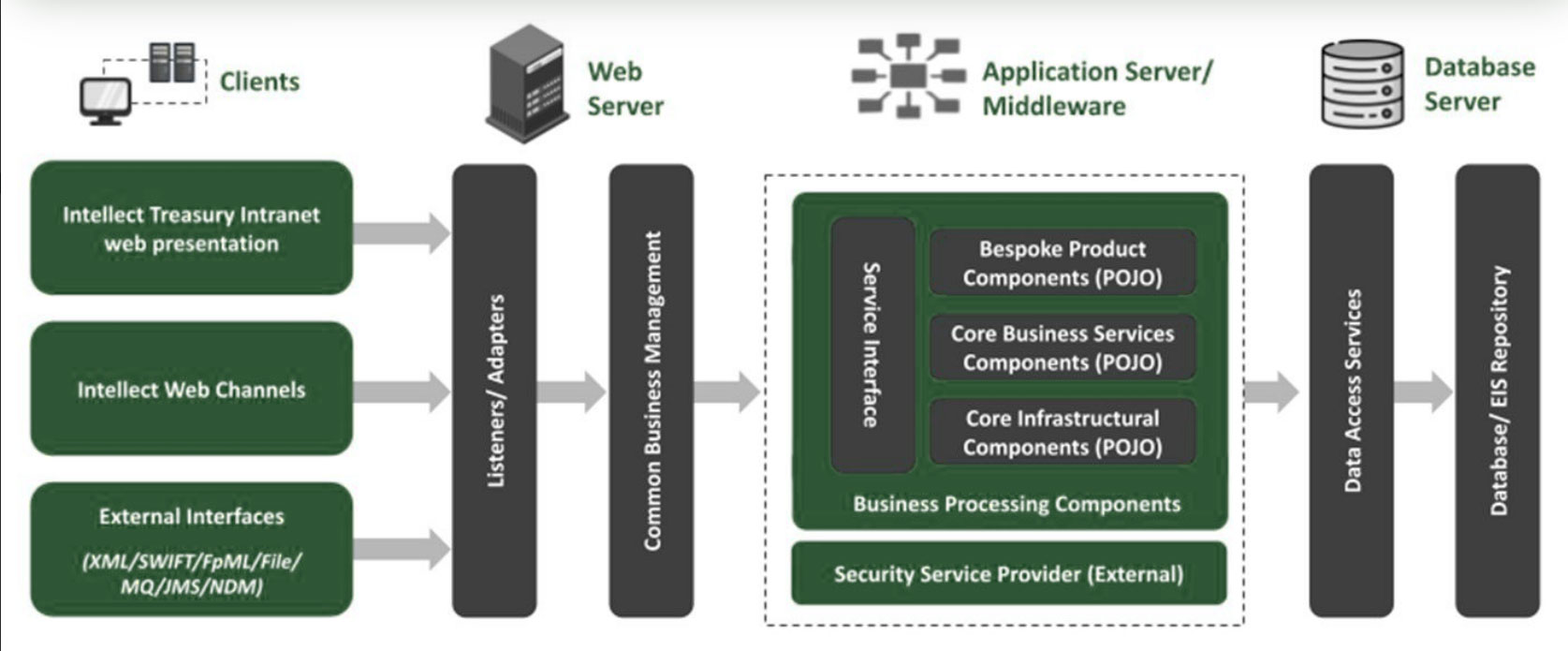

Composable NextGen Architecture

Seamless Integration

Scalable Middleware

Robust Security

Efficient Data Management

Why choose

eMACH.ai Treasury?

Boost Financial Performance

- Achieve top-line and bottom-line improvements of nearly 10% by optimizing capital leverage, increasing fee-based income, and minimizing operational inefficiencies

Intuitive and Agile Product Expansion

- The user-friendly GUI ensures rapid time-to-market for new products, enabling financial institutions to adapt quickly to evolving market demands

Comprehensive Risk and Profitability Management

- Monitor risk exposure in real time for optimal leverage, while driving profitability through advanced analytics

Integrated, Automated Treasury Operations

- Front Office: Seamless integration with trading portals for real-time trading and position management.

- Mid Office: Efficient risk monitoring and compliance frameworks with real-time analytics.

- Back Office: Fully automated reconciliation, settlements, and accounting processes, eliminating manual intervention and settlement risks.

Award-Winning

Innovations

Intellect Design Arena Played a pivotal role in shaping two of Forrester’s latest Trends and Vision reports on the present and future of Digital Banking Experiences

Ranked no.1 Retail Banking in IBSi Sales League Table 2025

Ranked no.2 in NORTH AMERICA REGIONAL in IBSi Sales League Table 2025

Ranked no.3 in GLOBAL LEADERSHIP CATEGORY in IBSi Sales League Table 2025

Recognized as a Leader in three quadrants and Best-of-Breed in one quadrant in Chartis’ RiskTech Credit Risk Management Solutions 2025 Quadrants report

Collateral Management solution is positioned as a “Leader” in Capital Markets Buy-Side and Sell-Side 2023 Quadrant report

Intellect Ranked No. 3 in Global Leadership – Geographic spread in IBSi Sales League Table 2024

Explore.

Learn.

Innovate.

FAQs

How does eMACH.ai Treasury integrate with existing banking systems?

eMACH.ai Treasury utilizes an API-first architecture that allows for seamless integration with existing banking systems, including RTGS, ICCOMS, and E-Treasury, facilitating data flow and operational efficiency across platforms.

What measures does eMACH.ai Treasury implement to ensure data security?

eMACH.ai Treasury employs multi-layered security protocols, including role-based access control, digital signatures, two-factor authentication, and comprehensive audit logs, ensuring the integrity and confidentiality of sensitive financial data.

What types of analytics does eMACH.ai Treasury provide?

The system offers extensive portfolio risk analytics, including metrics for Net Interest Income (NII), Earnings at Risk (EaR), and Funds Transfer Pricing (FTP), enabling informed decision-making across the treasury lifecycle.

Is eMACH.ai Treasury cloud-ready?

Yes, eMACH.ai Treasury is powered by a cloud-ready architecture, allowing for seamless integration with existing IT ecosystems and enabling scalability to meet evolving business needs.

How does eMACH.ai Treasury support regulatory compliance?

eMACH.ai Treasury provides robust security features, real-time reporting, and centralized data management, ensuring compliance with regulatory requirements.