Filipinos may shift to digital banks unless big banks act fast

Author: Paramdeep Singh, Regional Head, Asia Pacific, iGCB, Intellect Design Arena and Dimple Himashi DeSilva, Business Head, Digital Channels, iGCB, Intellect Design Arena for Business World

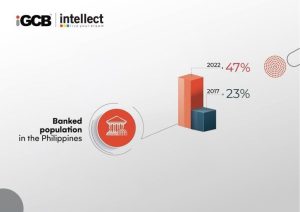

According to studies, over 80% of banked Filipinos say that they will continue to use digital banking services after the pandemic1. New players in the market have been quick to take notice. In the Philippines, the past five years have witnessed paradigm shifts in the banking landscape. In 2017, only 23% of Filipinos had bank accounts, with over 75 million citizens effectively unbanked2. Fast-forward to 2022 and those numbers have changed considerably, with nearly 47% of the adult population possessing a bank account3.

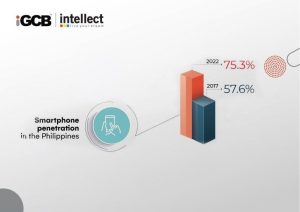

Much of this uptick can be traced back to the effects of the pandemic – the closure of physical bank branches during the series of lockdowns has channeled millions of Filipinos toward online banking services. When looked at in the context of the country’s massive smartphone penetration (75.3% in 2022), it becomes easier to see why digital banking has seen such a tremendous surge in recent years4.

In the past years six new digital-only banks (or Neobanks) have opened in the country and have rapidly gained traction.

The rise of digital banks

For the majority of unbanked, the need of the hour is for core banking services that include day-to-day deposits, withdrawals, payments, and accessible low-value loan products. Neobanks address this need with slick, easy-to-use UIs and streamlined digital onboarding processes, quick loans and competitive deposit interest rates, all accompanied by contextual experience. The technologically agile Neobanks are able to launch new offerings easily and integrate them within customers’ lifestyle needs like e-commerce and utilities. They can then integrate spending in these lifestyle needs with “Embedded Finance” options like BNPL along with an ecosystem of partners to provide greater value to the end customer through their own marketplace.

Contextual experience is key for incumbent banks to thrive

Incumbent banks have steadily started to focus on becoming truly digital with investments in API First composable architecture and AI-powered highly personalized omnichannel experience. To truly seize and retain market share, traditional Filipino banks can derive inspiration from platforms like Amazon, Instagram, Alibaba, WeChat and Grab – all highly successful global brands that create online experiences tailored to each user’s needs, lifestyle, finance, and

aspirations. These global brands are creating experiences across the lifecycle of a customer through a SuperApp and tying them with real-time products/offer suggestions to increase cross-selling. Gamification of every interaction, whether a first login, making a purchase or just browsing has been successfully implemented by these apps.

Think for a moment about how the philosophy of contextuality could be applied to the financial services sector. Imagine a banking service integrated with a travel marketplace that delivers customized trip financing options to a user. Or one-click deferred payments and short credit lines on a popular grocery delivery app. Ironically, traditional banks are in the perfect position to deliver the experience that digitally savvy competitors are creating.

Unlike Neobanks, traditional FS players typically have years, if not decades, of customer data to mine for insights and personalization needs. Even as they are handicapped with bulky legacy systems, they also have access to the capital required to quickly develop digital-only offerings and take them to market. By leveraging a Composable architecture and connected ecosystems, banks can reinvent the way they are perceived through SuperApp offerings. A SuperApp can help banks increase the addressable market, open new modes of revenue and speed up the go-to-market of new offerings. And finally, traditional banks have the foundation of trust and customer loyalty to support a rapid and successful shift to contextual banking – essential in a country like the Philippines, where 4 out of 10 still mistrust online banking. 5 This shift, however, will require a transformative overhaul of the banking sector and a tech-driven redesign of everything from their go-to-market strategies to back-end infrastructure and processes. Reinventing banking processes and systems that are already in use can be like doing a “ Heart Transplant on Local Anaesthesia” or “ Refuelling a Jet mid-air “. This thought however is being disrupted by banks either “hollowing their core “or even “evaluating Alternate Cores” for delivering superior customer experience for Digital Savvy Customers. Thanks to the advent of Cloud with Cloud Native Microservices Architecture, banks are able to adopt low-cost alternate IT platforms for digitally savvy customers on a “Pay by The Drink “model. What remains to be seen is whether banks in the Philippines have the innovation skills, risk appetite, and agility to retool and rearm themselves with ideas like the above and prepare themselves for the next big disruption.

Source: Business Mirror

References:

1 https://www.thinkwithgoogle.com/intl/en-apac/consumer-insights/consumer-journey/digital-finance-

transformation-philippines/

2 https://www.bsp.gov.ph/Inclusive%20Finance/Financial%20Inclusion%20Reports%20and%20Publication

s/2019/2019FISToplineReport.pdf

3 https://mb.com.ph/2022/05/19/number-of-unbanked-filipinos-decreases-as-digital-finance-supports-daily-

needs/

4 https://www.statista.com/statistics/625427/smartphone-user-penetration-in-philippines/

5 https://www.thinkwithgoogle.com/intl/en-apac/consumer-insights/consumer-journey/digital-finance-

transformation-philippines/

| For Media related info, please contact: Nachu Nagappan Intellect Design Arena LtdMob: +91 89396 19676Email: nachu.nagappan@intellectdesign.com | For Investor related info, please contact:Praveen MalikIntellect Design Arena LimitedMob: +91 89397 82837Email: Praveen.malik@intellectdesign.com |