eMACH.ai DEP

SME Engagement

Drive superior experience for SME customers across their lifecycle with

eMACH.ai Digital Engagement Platform

The Most Comprehensive SME Digital Banking Engagement Suite

eMACH.ai Digital Engagement Platform (DEP) for SME is designed to revolutionize the small and medium-sized enterprise banking experience. With our platform, you gain access to a suite of solutions tailored specifically for SMEs. The platform reduces the complexities in SME and business banking processes, turning journeys into seamless experiences. The platform comes with a comprehensive set of features enabling your SME customers to view and manage their portfolio. Alongside the platform, empowers your employees to design better journeys in a codeless manner and service SME customers better.

Schedule a Meeting

Key Platforms Features

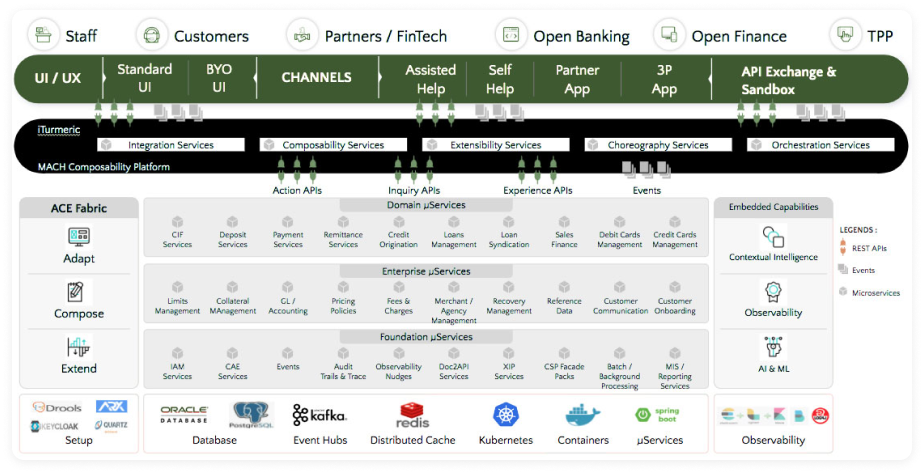

01

Unified platform for Retail, SME

& Corporate customers

across Acquisition,

Engagement and Retention

02

Composable UI/UX layer

for unique design and

seamless user experience

03

API-enabled, Cloud Native,

Microservices-based platform

with AI models (eMACH.ai) for

intelligent solutions

04

Codeless platform to Buy,

Adapt & Build user journeys

Proudly Serving

the Industry

Core Capabilities of eMACH.ai DEP for SMEs

What Our Clients Say

Award-Winning

Innovations

Ranked No. 2 Islamic – Digital Banking & Channels in IBSi Sales League Table 2024

Ranked No. 2 Digital Banking & Channels in IBSi Sales League Table 2024

iGCB’s Digital Engagement Platform (earlier called CBX-R) won Best Omnichannel Technology Implementation for implementation at Co-operative Bank of Kenya from The Asian Banker Global Middle East and Africa Awards 2023

iGCB’s Digital Banking Platform – CBX Retail recognized with a ‘Functionality Standout’ designation in Celent’s Report titled ‘Retail Digital Banking Platforms: International Edition’.

CBX Retail Digital Onboarding wins XCelent Functionality Award 2020

Intellect Design Arena named a Major Player in IDC MarketScape: North America Digital Banking Customer Experience Platforms 2022 Vendor Assessment (doc #US48061122, March 2022)”

iGCB’s Digital Banking Platform CBX Retail recognized with a ‘Functionality Standout’ designation in Celent’s ABC Analysis Report titled ‘Retail Digital Banking Platforms North America Edition – Solutions for Midsize and Large Banks’.