eMACH.ai

Quantum

Purpose-built Digital Technology Solution for Central Banks

Accelerating Progressive

Transformation for Central Banks

eMACH.ai Quantum stands as the world’s premier core banking solution, distinguished by its central bank-specific functionalities. Built on the eMACH.ai platform (Events, Microservices, API, Cloud, and Headless), it streamlines and enhances central banking operations, ensuring financial market stability and reducing complexity. Offering unmatched efficiency, composability, maintainability, and scalability, eMACH.ai Quantum adapts to the evolving needs of central banks. Beyond a core banking system, it includes comprehensive financial risk management, safeguarding the integrity of central banking operations. Choose eMACH.ai Quantum for a future-proof, optimal financial technology solution.

Schedule a Meeting

Next-Generation

Central Banking

01

Faster Policy

Implementation

Enables rapid policy rollout with integrated features,

enhancing central bank operational efficiency.

02

Seamless

Composability

Easily integrates with existing systems, ensuring

smooth and flexible customizations for future needs.

03

Scalable to Future

Requirements

Built to grow with evolving central banking needs,

ensuring long-term adaptability and robustness.

Preferred eMACH.ai Quantum solution for top central banks globally

Accelerating Progressive Transformation Journey

for Central Banks

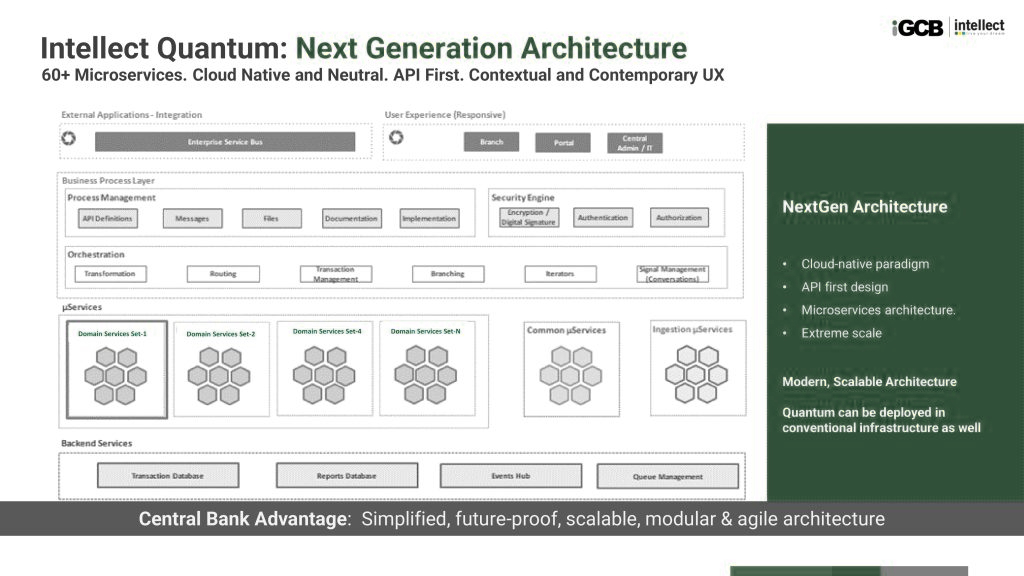

Fully Composable

Microservices Architecture

Delivers seamless composability, extensibility, integration, and security, empowering central banks with a future-proof solution.

Effectively implement the monetary policies and real-time control for maintaining financial stability.

Why choose

eMACH.ai Quantum?

Rapid policy implementation

- Highly flexible business rules configuration with over 1000 prebuilt parameters

- Enabling financial inclusion through direct to public payments for various government schemes

Zero Reconciliation and real-time Balance Sheet

- Treasury Single Account (TSA) with real-time balance consolidation for government for improved fund management at the national level

- Seamless navigation from general ledger (GL) to transaction level details at the click of a button

Realtime accurate data-driven decision making

- 360’ degree view and real-time visibility on the financial health and risks of commercial banks & Governments

- Real-time monitoring of currency in circulation

Transforming

Challenges into

Success Stories

Case Study: Progressive Modernization at Reserve Bank Of India

95% reduction in operational risk

Elimination of reconciliation for 30,000+ transactions

Processing capacity of over 100 million transactions per day

FAQs

What distinguishes eMACH.ai Quantum from traditional Core Banking Systems?

eMACH.ai Quantum is designed for central banks, offering integrated solutions to tackle challenges like complex regulations and real-time data management.

How does eMACH.ai Quantum facilitate government services?

eMACH.ai Quantum provides an online banking services portal that enhances interaction between banks, government entities and the central bank, streamlining processes such as tax collection, payments, and public debt management.

What performance metrics does eMACH.ai Quantum achieve?

eMACH.ai Quantum supports over 113 million transactions per day, handles more than 30 million ISO20022 payment messages daily, and boasts a remarkable uptime of 99.999%, ensuring reliable and efficient operation.

How does eMACH.ai Quantum enhance security and resilience?

eMACH.ai Quantum incorporates robust security measures, including role-based access, advanced encryption, and continuous monitoring, ensuring the integrity and resilience of central banking operations against potential threats.

What types of operations does eMACH.ai Quantum support?

eMACH.ai Quantum supports a wide range of operations, including real-time financial statements, liquidity management, national payments systems, and comprehensive risk analytics for effective decision-making.