eMACH.ai

SME Marketplace

Providing a Superlative Credit Experience to your SME Customers. Ensure faster access to credit with loan disbursements in minutes rather than weeks!

Launch your SME business in just 50 days

This platform is India’s first end-to-end digital SME credit management solution, enabling you to launch your SME business in just 50 days. It allows to create segment-specific credit offerings, deliver an exceptional customer experience across all channels, and provide faster access to credit with loan disbursements in minutes. Designed to transform your SME lending business, this platform helps you make quicker, data-driven credit decisions, reduce operational costs, manage risks proactively, and collaborate seamlessly with fintech partners to originate loans across multiple channels.

Schedule a Meeting

Challenge,

Innovate

and Grow

01

Smarter and Faster

Origination

Omni-channel origination

Document management

Auto adjudication

Digital data aggregation

API-based origination

Auditable conversations

02

Comprehensive and Flexible

Loan Management System

Loan servicing

Powerful product configuration engine

Superior flexibility in amortization

Exhaustive loan parameters

Loan restructuring & modifications

03

Multi-Dimensional

Exposure Management

Enterprise limit monitoring

Real-time margining tracking

Multi-dimensional exposure view

04

Integrated Debt

Management

Proudly Serving

the Industry

Curate Unique Products And Experiences

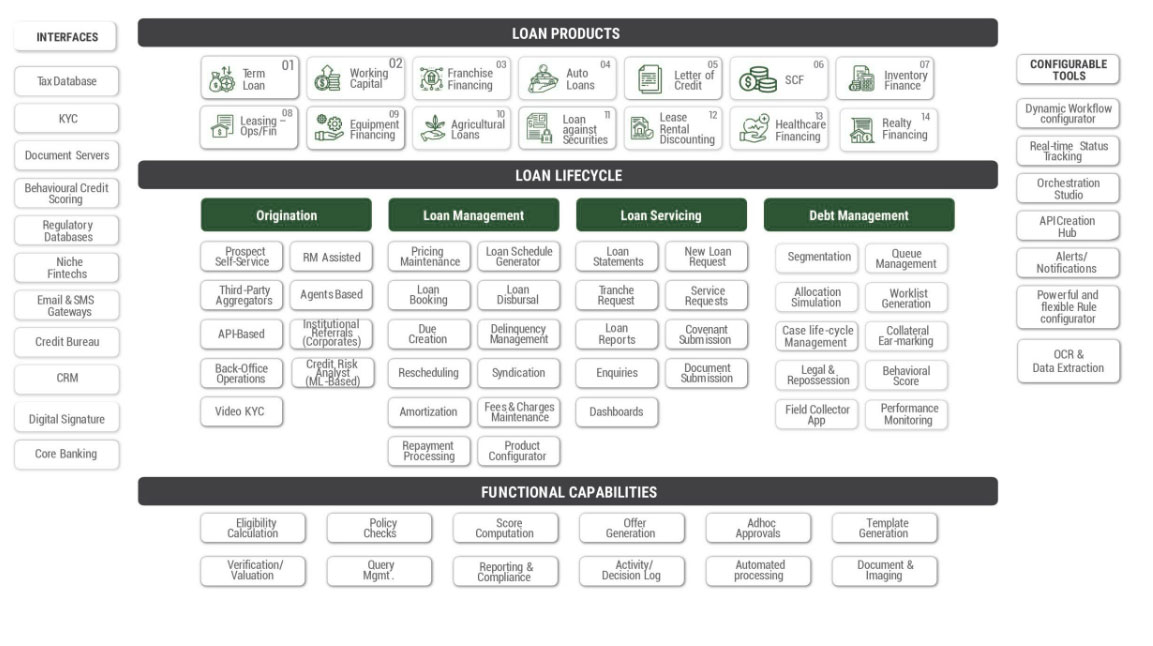

Solution

Architecture

Comprehensive Loan Management

Configurable Loan Products

Integrated Functional Capabilities

Why Choose

eMACH.ai Lending for SME?

Curate Unique Credit Experiences for SMEs – iGCB

Launch differentiated products and deliver them on any channel with digital journeys that are paperless, personalized, and comprehensive:

- 50+ ready-to-use out of box configurable product templates.

- In-built marketplace to provide contextualized credit experiences for your SME customers.

- Integrated platform with loan servicing and management, limits monitoring and debt management modules.

- Real Time 360-degree view of customers enabling up/cross-sell via integrations.

Drive “Application to Sanction’ in minutes

Enable Customers to self-initiate loan applications and receive credit decisions in minutes:

- Leverage a powerful ecosystem to aggregate information from a wide range of structured and unstructured database for rapid decisioning

- 50+ API service calls to fetch, authenticate and analyse data.

- Configurable Rule Engine to automate eligibility computation, generate offers and provide sanctions instantaneously.

- Eliminate customer drop outs by seamlessly integrated Relationship Manager Assisted workflows.

Accelerate your business growth

Collaborate with Aggregators/Fintechs and other business partners to bring in customers from various micro markets:

- Omni-channel digital credit on-boarding to grow your business without corresponding increase in physical and technological infrastructure

- Leverage API-based onboarding to scale up volumes with zero touch processing

- Digitize end-to-end SME credit management to rise above the constraints of business hours, availability of RMs and service staff, and productivity challenges.

- ‘Try-Test-Grow’ with Zero capex commercial model to enable ‘pay as you go’

Manage risks proactively

AI-powered portfolio monitoring to assess risks at real time:

- Leveraging Intellect Sherlock, an AI enabled portfolio monitoring engine, to scan the external environment for events impacting your portfolio and generate early warning alerts’.

- Analyse various internal and external data patterns, transactions, and repayments to compute probability of default and take timely remedial action

Transforming

Challenges into

Success Stories

Case Study: A leading bank in Zimbabwe partners with iGCB to transform Core Banking

100 business days

support over 11,500 transactions per second

200% increase in transaction processing capacity

Case Study: Utkarsh Small Finance Bank goes live with comprehensive core banking

Case Study: Driving Digital Transformation for a subsidiary of Santander UK

Case Study: Transforming Sonali Bank’s Core Banking

Award-Winning

Innovations

Intellect Design Arena Played a pivotal role in shaping two of Forrester’s latest Trends and Vision reports on the present and future of Digital Banking Experiences

Ranked no.1 Retail Banking in IBSi Sales League Table 2025

Ranked no.2 in NORTH AMERICA REGIONAL in IBSi Sales League Table 2025

Ranked no.3 in GLOBAL LEADERSHIP CATEGORY in IBSi Sales League Table 2025

Recognized as a Leader in three quadrants and Best-of-Breed in one quadrant in Chartis’ RiskTech Credit Risk Management Solutions 2025 Quadrants report

Rated as a Leader in ‘The Forrester Wave Digital Banking Processing Platforms for Retail Banking, Q3 2022’

Intellect Ranked No. 3 in Global Leadership – Geographic spread in IBSi Sales League Table 2024

Explore.

Learn.

Innovate.

FAQs

What is Digital Core Banking, and how does it work?

Digital Core Banking is a cloud-native platform that modernizes traditional banking operations. It enables real-time transactions, integrates with fintech ecosystems, and delivers personalized customer experiences using AI.

Why should banks upgrade to a digital core banking platform?

Upgrading helps banks improve scalability, speed up product launches, enhance compliance with regulations, and meet evolving customer expectations for seamless banking experiences.

How does Digital Core Banking support Open Banking initiatives?

The platform is Open Banking-ready, offering secure APIs that enable banks to share data with third-party providers while adhering to standards like PSD2.

What industries can benefit from Digital Core Banking?

Digital Core Banking supports retail, corporate, and SME banking, making it versatile for banks serving diverse customer segments.

How does AI enhance Digital Core Banking systems?

AI drives features like predictive analytics, customer segmentation, fraud detection, and personalized banking, boosting efficiency and customer satisfaction.