eMACH.ai

Cards

Fully customizable solution that meets customer needs, driving value in card businesses

Unlock a connected Cards Ecosystem, serving all cards & payment needs in one place

We are thrilled to announce the launch of eMACH.ai Cards, a state-of-the-art, fully DIY and customizable cards platform designed to meet every customer need. Built on First Principles, the next-gen eMACH.ai Cards architecture leverages the 4C framework to empower your cards business with:

- Control – Placing control in the hands of the end-customer

- Comprehensive – Providing a holistic functional and technological solution, including advanced card issuing solutions and a centralised card management system

- Collaboration – Adopting an ecosystem-enabled approach to leverage marketplace advantages with the Open Finance enabled solution

- Conscious – Inspiring a sustainable mode of living, one swipe at a time

In our mission to #UncomplicateCards, this fully digital platform addresses all card business needs, including issuing, fraud monitoring, loyalty, servicing, and delinquency management. Embrace the future of card issuance with eMACH.ai Cards!

Schedule a Meeting

Transforming Credit Management

01

Accelerated

Time-to-Market

Launch your cards business in just 50 days with pre-configured solutions

Enable customer onboarding in under 2 minutes using AI-powered tools and real-time KYC

02

Next-Generation

MACH Architecture

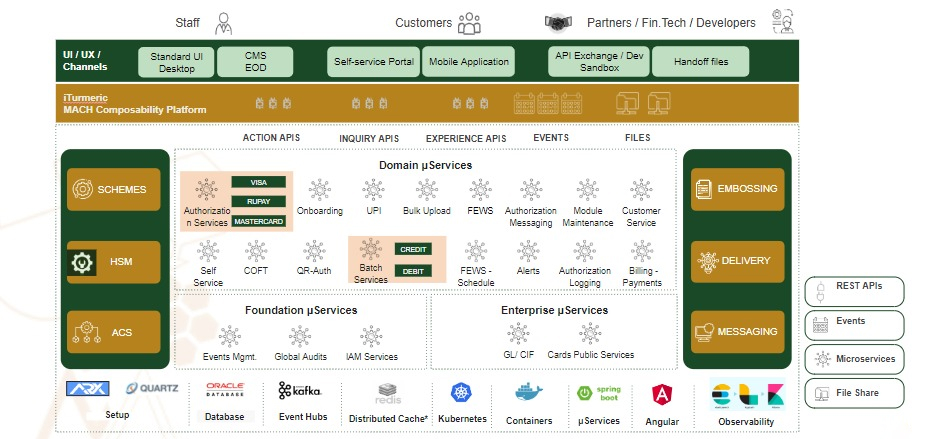

Powered by 270+ Packaged Business Capabilities (PBCs) for on-the-fly solution design

Supports low-code customization for rapid innovation and adaptability

03

Recognized

Excellence

Partnered with leading organizations like YES BANK, Mauritius Telecom, and VMware

Recognized globally for innovation and leadership in retail and transaction banking

Preferred Cards platform for top banks globally

Challenge, Innovate and Grow

Solution Architecture

User-Centric Interfaces

Flexible services modules with secure transactions

Real-Time Monitoring

Why choose

eMACH.ai Cards?

Disrupt and challenge the status quo

Launch hyper-personalized card solutions with more than 25 parameters enabled by a DIY GUI interface

- MACH- enabled architecture that supports innovating at speed, unlocking true customer delight

- 270+ composable Packaged Business Capabilities (PBCs) for conceiving credit solutions on the fly supported by our proprietary Customisable enablement Kits (CEKs – SDK++)

- Low code application development digital platform for customized development

Onboard Customers in less than 2 Minutes

Instant credit decisioning powered by Intellect’s private, public and Partner APIs and a robust Business Rule Engine

- Enable customers to apply for the card from the comfort of their homes through partner digital channels

- Estimate customer’s income leveraging AI/ML-based models, ensuring swift pre-approvals and reduced NPA risks

- Instant and paperless KYC completion through Video and Biometric modes facilitated by real time integration with National Unique Identification System

Drive sustainability in payments – one swipe at a time

‘Give Back’ with your first Truly Green Card in the market. Enable your customers to be more socially conscious by reducing their carbon footprint

- Live Conscious Meter – highlighting your customers’ Carbon Footprint to assess environmental, social and governance impact

- Motivate customers to donate to social or environmental causes. Enable them to redeem rewards for sustainable purchases

- ESG rule-engine aligned to Canadian Net-Zero Emissions Accountability Act (2021)

Launch your cards business in 50 days!

With our Card as a Service (CaaS) proposition, start issuing feature-rich payment cards to your customers in 50 days!

- ‘Try-Test-Grow’ with Zero capex commercial model to enable ‘pay as you go’

- Leverage our industry experts for custom-made payment solutions and sage counsel on compliance matters

- Delegate the management of end to end cards solution and operations – including launching powerful self-service channels and customer services function

Transforming

Challenges into

Success Stories

Case Study: Innovative Financial Empowerment Through Advanced Payment Solutions

Seamlessly migrated 1.4 million cards to MasterCard

Enhanced customer engagement by introducing new channels for interaction

Achieved PCI compliance and secure MasterCard access

Case Study: Enabling a Leading Indian Bank to Launch a Superlative Card Experience

Case Study: Launching Credit Card Business for One of the Largest Banks in South East Asia

Case Study: Leading Private Sector Bank in India transforms its loan origination & credit card solution

Award-Winning

Innovations

Intellect Design Arena Played a pivotal role in shaping two of Forrester’s latest Trends and Vision reports on the present and future of Digital Banking Experiences

Ranked no.1 Retail Banking in IBSi Sales League Table 2025

Ranked no.2 in NORTH AMERICA REGIONAL in IBSi Sales League Table 2025

Ranked no.3 in GLOBAL LEADERSHIP CATEGORY in IBSi Sales League Table 2025

Recognized as a Leader in three quadrants and Best-of-Breed in one quadrant in Chartis’ RiskTech Credit Risk Management Solutions 2025 Quadrants report

Intellect Ranked No. 3 in Global Leadership – Geographic spread in IBSi Sales League Table 2024

Intellect Ranked No. 2 among Regional Leaders in North America in IBSi Sales League Table 2024

Explore.

Learn.

Innovate.

FAQs

How does the platform enable instant credit decisioning?

It uses AI/ML-based models, robust APIs, and a Business Rule Engine for swift pre-approvals, ensuring reduced NPA risks and paperless KYC completion.

How quickly can I launch a card solution?

With the CaaS (Card-as-a-Service) model, you can launch a feature-rich cards solution in just 50 days, leveraging a pay-as-you-go approach with zero capex.

Does it support flexible payment options like BNPL?

Yes, it supports BNPL transactions, allowing easy conversion into EMIs with minimal customer interaction and a seamless process.

What are the rewards and loyalty features?

The platform supports event-based accrual, multiple redemption options (cashback, buy points, etc.), and co-brand points conversion.

What analytics capabilities does the platform provide?

It analyzes portfolios to identify opportunities, monitors transactions across channels, and uses a real-time decision engine for approvals.