eMACH.ai

Digital Engagement Platform

Unified Digital Engagement Platform helping Banks & Credit Unions deliver personalized, intuitive, and omni-channel experiences, redefining engagement, driving loyalty, innovation, and growth in a digitally connected world

World’s Most Comprehensive Digital Engagement Platform

eMACH.ai DEP is the unified Digital Engagement Platform revolutionizing how Retail, SME, and Commercial Banks and Credit Unions connect with their customers and members. By delivering seamless, contextual experiences across the entire customer lifecycle—from acquisition and engagement to retention—our codeless, cloud-native platform empowers banks to innovate faster. With an extensible architecture and AI-enabled user journeys, eMACH.ai DEP enables personalised, omnichannel interactions through self-service and assisted channels, driving deeper relationships, agility, and sustainable growth. The platform is Open Finance enabled and helps Banks and Credit Unions connect to an external ecosystem.

Proudly Serving

the Industry

Deliver Seamless &

Personalised Experiences Easily

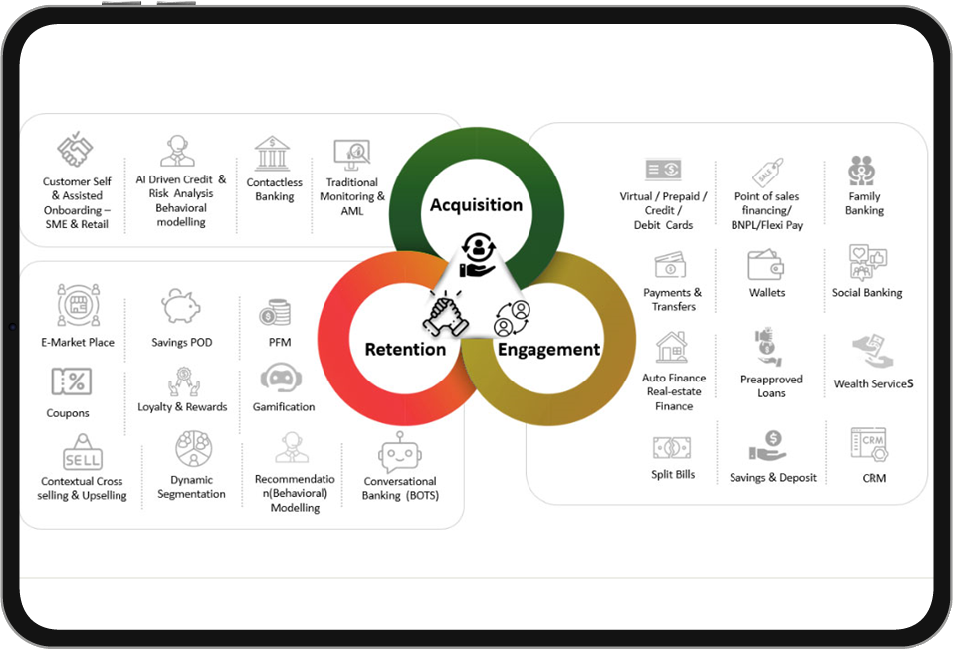

Unified platform for Retail, SME & Corporate customers across Acquisition, Engagement and Retention

Microservices-based, Event-driven, API-enabled, Cloud Native, Headless with underlying AI models (eMACH.ai) Platform

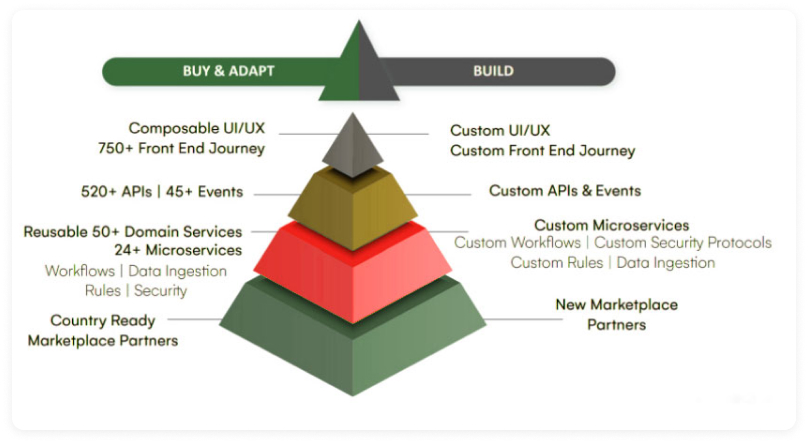

Codeless platform to Buy, Adapt & Build user journeys

Create a unique design and experience with a composable UI/UX layer

Pre-integrated with best-in-class fintech partners to offer differentiated solutions and drive growth

Connect with any core banking system, Applications, Fintechs & other Marketplace partners

Engage with your customers

eMACH.ai DEP’s omnichannel platform empowers banks and credit unions to deliver personalized experiences tailored to every customer, device, and lifecycle stage. By unifying data and insights across all channels, eMACH.ai DEP enables seamless interactions that drive loyalty and satisfaction.

Whether onboarding new customers, deepening existing relationships, or re-engaging inactive members, our platform adapts to meet diverse needs. Its robust analytics and AI-driven capabilities ensure every touchpoint feels unique, fostering trust and connection.

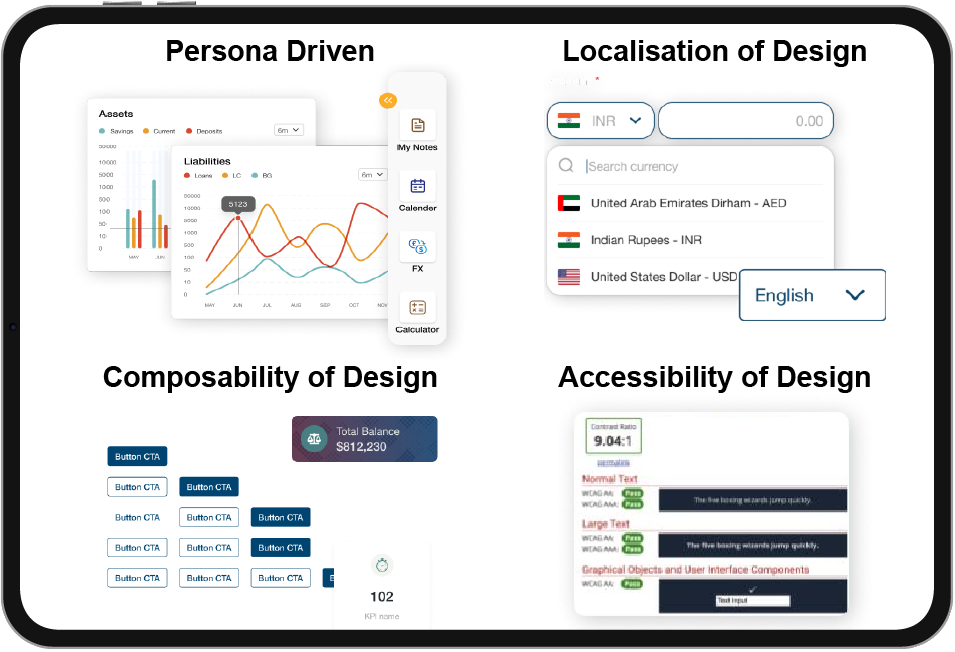

Bring Delight with Impressive UI/UX

- eMACH.ai DEP delivers a seamless and intuitive interface designed to cater to diverse user preferences and business needs.

- Our approach considers key factors like customer segments, demographics, generations, and geographical preferences to ensure an engaging and user-friendly experience.

- Built with over 57 reusable components, our platform allows for easy customization to meet the specific requirements of banks and their customers.

- The platform is designed to align with regional preferences, supporting various languages and currencies for global accessibility.

- eMACH.ai DEP adheres to strict accessibility standards (WCAG) by ensuring proper color contrast, keyboard navigation, and descriptive alt text, making it inclusive

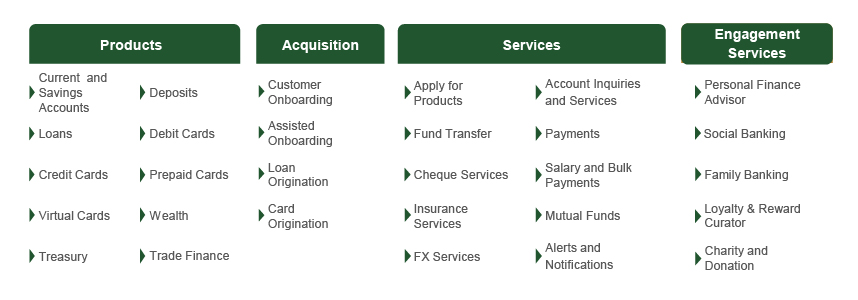

Kickstart with comprehensive experiences for your customers

Built as a unified platform for Retail, SME, and Commercial banking segments, eMACH.ai DEP delivers seamless, end-to-end user journeys—from member onboarding and digital lending to bill payments, investments, and delegation management. With advanced engagement tools like PFM, loyalty programs, and gamification, eMACH.ai DEP drives deeper connections. Beyond banking, ESG and lifestyle offerings enhance value. eMACH.ai DEP enables banks and credit unions to simplify operations, improve scalability, and deliver exceptional experiences across all customer segments.

Empower your employees with smarter tools

eMACH.ai DEP equips banks and credit unions with a sophisticated back-office application designed to empower their employees with essential tools and functionalities.

- Customer Onboarding Management: Centralize onboarding for retail, corporate, and SME clients, allowing employees to track journeys in real-time for quicker approvals.

- Entity Management: Offer a unified view of customer entities and relationships, simplifying the management of complex hierarchies.

- User Management: Implement role-based access controls for secure management of user roles and permissions.

- Content Management: Enable employees to create and manage customer communication content, ensuring consistent messaging.

- Segmentation and Limits Management: Facilitate the definition of customer segments with customizable offers based on demographics and behaviors.

- Fee & Charges Management: Provide tools to configure fees transparently while ensuring regulatory compliance.

- Workflow Creation: Allow users to establish authorization matrices across various levels.

Innovate easily with Open Finance enabled eMACH.ai Architecture

Built on a composable eMACH.ai (Events, Microservices, API, Cloud, Headless architecture, AI) platform, eMACH.ai DEP comes with comprehensive microservices across Domain, Engagement, Contextualization, Data ingestion and Process Choreography. The platform can connect with any user experience layer upstream and any core banking, 3rd party applications, Fintechs and Marketplace players downstream. eMACH.ai DEP is available in a Multi-Tenant model with the ability to have tenant-specific front-end, business process versions and Logical and physical partitions of tenant-specific data.

Extend user journeys with a Codeless platform

eMACH.ai DEP comes with the most 750+ Front-end journeys, 50+ Domain Packs (across onboarding, lending, cards, payments, PFM, e-commerce marketplace, ESG etc), 520+ Open APIs, 45+ Events, workflows and more. This gives banks a jumpstart to launching an amazing banking experience. Banks can further choose to adapt each experience with a drag and drop or build a completely new experience from scratch without any coding requirement.

Transform Banking

with Agility & Precision

What Our Clients Say

Transforming

Challenges into

Success Stories

Case Study: A top UAE Bank cuts SME onboarding time by 98% with eMACH.ai Digital Engagement Platform

98% reduction in SME Onboarding time

10/10 NPS score from the bank for customer experience

First bank in UAE to use Blockchain for customer authentication

Case Study: Intellect Powers CDB Sri Lanka’s Award-winning Digital Banking

Case Study: Intellect fuels aggressive growth for YES Bank, a leading private sector bank in India

Award-Winning

Innovations

Best Digital Banking Platform award by Fintech Future Banktech Awards 2025 to eMACH.ai DEP

Featured among 26 global vendors in Celent’s Decoding Small Business Digital Banking Platform report for Functionality and Technology Innovation

Intellect Design Arena Played a pivotal role in shaping two of Forrester’s latest Trends and Vision reports on the present and future of Digital Banking Experiences

Ranked no.1 Retail Banking in IBSi Sales League Table 2025

Ranked no.2 in NORTH AMERICA REGIONAL in IBSi Sales League Table 2025

Ranked no.3 in GLOBAL LEADERSHIP CATEGORY in IBSi Sales League Table 2025

Honored as a Functionality Standout in Celent’s Small Business Digital Banking Platform: APAC Edition

FAQs

How can modern Digital Engagement Platforms improve experience?

Modern platforms like eMACH.ai DEP enhance user experience with personalized, seamless engagement across stages and channels. Using AI for tailored recommendations, gamification, loyalty rewards, and secure processes, they build trust and foster value-driven relationships.

Can eMACH.ai DEP integrate with existing core banking systems and fintech partners?

Yes, eMACH.ai DEP is designed to seamlessly connect with any core banking system (including iGCB’s core banking platform), as well as applications, fintechs, and other marketplace partners, ensuring inter-operability and ease of integration.

What measurable benefits have customers achieved with eMACH.ai DEP?

Banks using eMACH.ai DEP have achieved faster onboarding in 3 minutes, reduced digital platform costs, increased wallet share, and accelerated product launches, all contributing to improved operational efficiency and customer growth.

Does eMACH.ai DEP support Open Banking & Open Finance?

Yes, eMACH.ai is Open Banking & Open Finance compliant. Banks can leverage iGCB’s marketplace or connect with third parties through Open APIs to deliver a curated experience for their customers.

Which industries does eMACH.ai DEP serve?

eMACH.ai DEP is a modern digital engagement platform which helps banks and credit unions provide seamless, personalised and intuitive experience to their customers.