Credit Unions

Creating a high-touch digital experience

without limiting the personal touch

Empowering Lifestyles for

Credit Union Members

At the heart of every credit union is a mission to serve members with care, integrity, and innovation. iGCB understands the unique challenges you face—creating meaningful connections while driving growth, managing costs, and mitigating risks. Our solutions empower credit unions to deepen member relationships through personalized, seamless experiences, unlock new revenue streams with modernized services, optimize operational efficiency to control costs, and proactively address risks with intelligent, integrated tools. Together, we can reimagine the future of your credit union, where every interaction builds loyalty, fosters growth, and ensures long-term success.

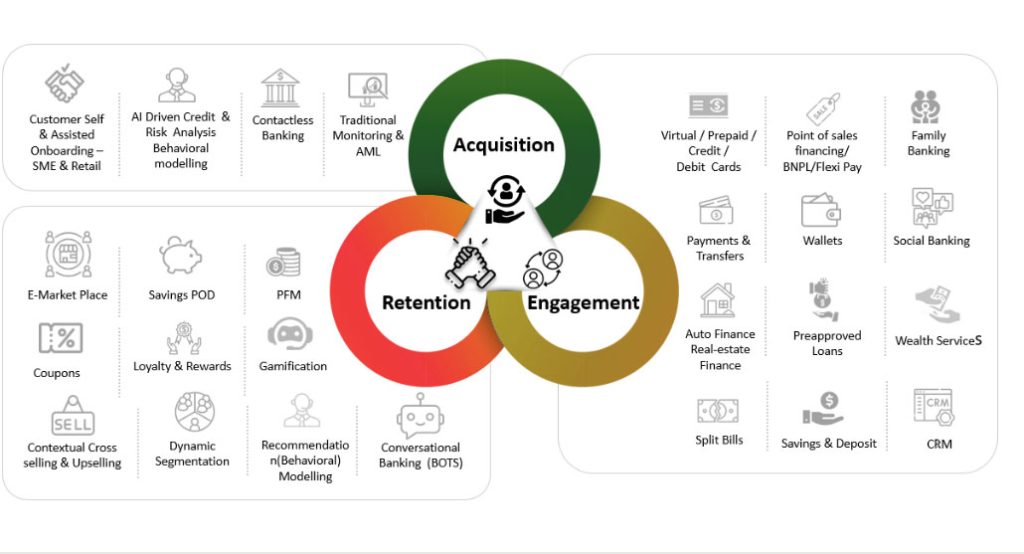

One platform – 3600 Engagement

Best Fit for Credit Unions

eMACH.ai DEP

Unified Digital Engagement Platform that helps Banks and Credit Unions offer a seamless, contextual engagement across the entire customer lifecycle—from acquisition and engagement to retention

What Our Clients Say

Transforming

Challenges into

Success Stories

Case Study: A leading bank in Tanzania improves customer experience & revenue with Core, lending & digital channel transformation.

3 minute onboarding for retail customers, cut from 15 to 4 steps

10 minute account opening vs 1-2 hours earlier

2000+ daily payments, enhanced processing capacity per branch

Case Study: Innovative Financial Empowerment Through Advanced Payment Solutions

Case Study: A leading bank in Zimbabwe partners with iGCB to transform Core Banking

Case Study: Enabling a Leading Indian Bank to Launch a Superlative Card Experience

Award-Winning

Innovations

Ranked No. 2 Islamic – Digital Banking & Channels in IBSi Sales League Table 2024

Ranked No. 2 Digital Banking & Channels in IBSi Sales League Table 2024

iGCB’s Digital Engagement Platform (earlier called CBX-R) won Best Omnichannel Technology Implementation for implementation at Co-operative Bank of Kenya from The Asian Banker Global Middle East and Africa Awards 2023

iGCB’s Digital Banking Platform – CBX Retail recognized with a ‘Functionality Standout’ designation in Celent’s Report titled ‘Retail Digital Banking Platforms: International Edition’.

CBX Retail Digital Onboarding wins XCelent Functionality Award 2020

Intellect Design Arena named a Major Player in IDC MarketScape: North America Digital Banking Customer Experience Platforms 2022 Vendor Assessment (doc #US48061122, March 2022)”

iGCB’s Digital Banking Platform CBX Retail recognized with a ‘Functionality Standout’ designation in Celent’s ABC Analysis Report titled ‘Retail Digital Banking Platforms North America Edition – Solutions for Midsize and Large Banks’.

Explore.

Learn.

Innovate.

-

Faisal Islamic Bank of Egypt accelerates its Retail Banking Transformation journey with eMACH.ai Digital Engagement Platform

NewsJuly 9, 2025 -

Webinar: Acquire & Retain Customers Digitally – at 30% Lower Cost

EventsJune 19, 2025 -

First Abu Dhabi Bank (FAB), UAE’s global bank, accelerates digital transformation with Intellect’s eMACH.ai Lending, setting new standards in debt management

NewsJune 16, 2025